CWS Market Review – September 14, 2018

“A lot of people with high IQs are terrible investors because they’ve got terrible temperaments. You need to keep raw, irrational emotion under control.”

– Charlie Munger

On Thursday, our Buy List broke the double-digit barrier. We’re now up 10.41% for 2018 (not including dividends). So far this year, sixteen of our 25 stocks are beating the S&P 500. Here’s something to consider. In this day of tech media giants, our two best performers this year are a freight-services company and a wallboard company. Boring, sure, but we’ll take those gains any day.

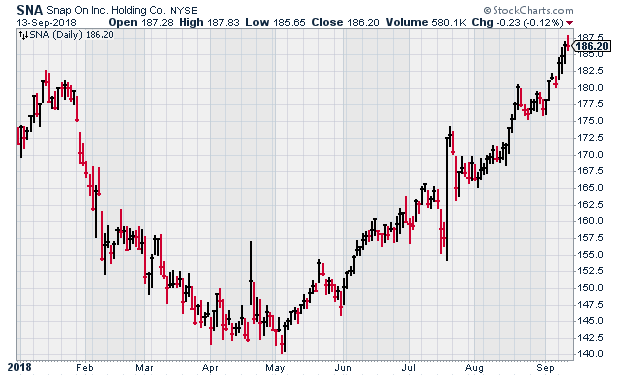

In this week’s CWS Market Review, I want to cover some recent economic news, including last week’s jobs report and this week’s subdued inflation report. I also want to touch on an overlooked issue which is the spreading chaos in emerging markets. This isn’t getting the attention it deserves. I’ll also cover some recent news impacting our Buy List. (BTW, have you noticed the big rally in Snap-on? Up 30% since May!) But first, let’s take a closer look at the August jobs report.

The “Raise-Less” Recovery

Last Friday, the government reported that the U.S. economy created 201,000 net new jobs in August. That’s basically in line with the current trend. Over the last seven years, the economy has created 17.3 million new jobs. That’s an average of 205,000 per month. Officially, the unemployment rate is 3.9%. The current unemployment rate is lower than it was in every single month during the 1960s, 1970s and 1980s.

While that’s good news, there are some weak spots to note. Not as many Americans are in the workforce as there were a few years ago (although this trend isn’t as bad as some alarmists would lead you to believe). This trend may soon change. This week’s report on job openings was an all-time record. There were 6.9 million job openings in July. That’s the highest since the data series started in 2000. Another report from small businesses showed that more companies are having trouble finding new workers, and Thursday’s initial jobless claims report was another 49-year low.

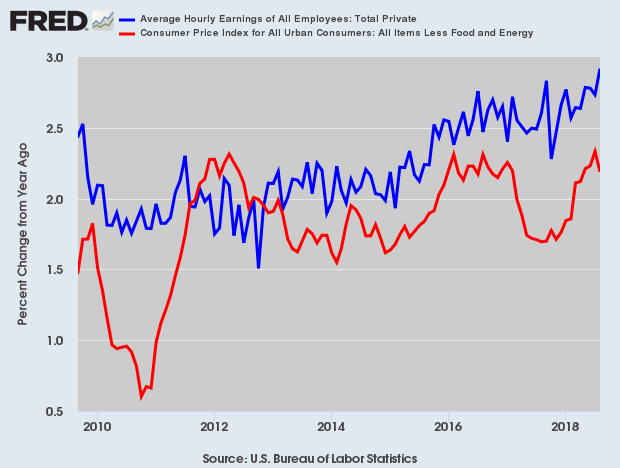

The other weak spot in the economy is wages. You would think that with emerging labor shortages there would be an increase in worker pay. While there’s been some improvement there, it’s not much to celebrate. In the last year, average hourly earnings are up 2.9%. The last economic recovery was described as a “jobless” recovery. This one seems to be a “raise-less” recovery.

Here’s the growth of wages in blue just narrowly beating out core inflation in red:

As investors, wage growth is important to us because that’s where future business revenue comes from. We want to see more shoppers. This leads us to the issue of inflation. With subdued wages, there hasn’t been much pressure on consumer prices. On Thursday, Wall Street had been expecting the August CPI report to show an increase of 0.3%. Instead, it came in at 0.2%. In the last year, inflation is running at 2.7%. The number is a bit skewed because inflation ran slightly hot in late 2017. Over the last six months, inflation is running just under 1%. Expect to see that 2.7% number trend lower over the next few months.

I also like to look at the inflation report for “core prices” which excludes food and energy prices. In August, core inflation rose by just 0.08%. That’s the second-lowest report since January 2015. This really tells me that inflation isn’t a problem. The bond market continues to be quite happy with the current state of things. The 10-year Treasury is still below 3%. I don’t think a lot of bond watchers thought that would happen.

All this leads us up to the next Fed meeting which is scheduled for September 25-26. The odds are roughly 99.9999999% that the Fed will raise rates at this meeting, though I could be low-balling it. Another rate increase would bring the target for Fed funds up to 2% – 2.5%. That would bring real rates (meaning, after inflation) all the way up to 0%. Real interest rates have been negative for 14 of the last 17 years.

There’s also a chance another rate hike could finally invert the yield curve. The spread between the two- and ten-year Treasuries is currently just 21 basis points. That’s close to being the lowest point in 11 years. A rate hike in December is still an open question, though I seem to be in the minority. Wall Street is nearly convinced the Fed will move again. I’m not so sure. While the economy is definitely improving, there’s still not much in the way of pricing pressures. The futures market even thinks there will be a third hike coming in May.

While I like all the stocks on our Buy List, I wanted to highlight a few that look especially good at the moment. Shares of Torchmark (TMK) dropped this week after they were downgraded by Goldman Sachs. I’m still a believer, and the lower share price helps. My Buy Below for TMK is $91, but if you can get it below $86, that’s a good deal.

I also wanted to highlight Signature Bank (SBNY). I’ll warn you that SBNY is a frustrating stock. It can be very volatile. The good news is they’ve recently started paying a dividend. The current yield is just under 2%. Signature is also going for just 10 times next year’s earnings. Any buy order below $120 is a smart move.

Chaos in Emerging Markets

While the U.S. still looks mostly good, some economies overseas are crashing on the rocks. This happens every few years, and it looks to be happening again. So far, the main culprits are Argentina, Russia, South Africa and Turkey. With any crisis like this, there’s always the worry of contagion, which means watching the meltdown spread from country to country.

All four countries have different reasons for the mess they’re in. Argentina borrowed too much. The peso got clobbered, and their Fed has had to jack up rates to 60%.

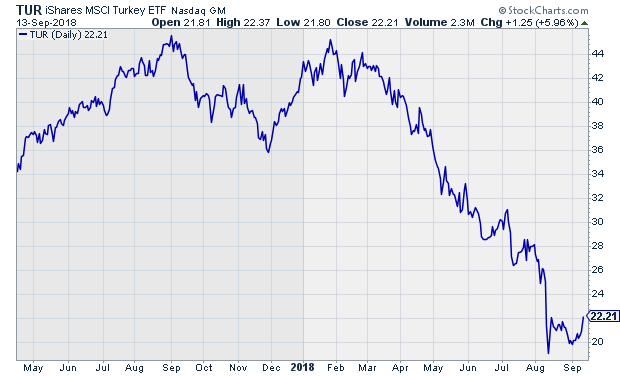

In Turkey, President Erdogan has made just about every bad economic decision possible. He recently said, “If they have dollars, we have our people, our righteousness and our God.” Apparently, the bond market prefers the dollars. On top of that, President Trump has doubled tariffs on Turkish steel and aluminum. Erdogan has also named himself the head of Turkey’s sovereign wealth fund, which I’m guessing won’t reassure foreign investors. To give you an idea of the kind of building that’s been going on, when Erdogan became president 15 years ago, there were 50 shopping malls in Turkey. Now there are over 400. Check out the plunge in the Turkey ETF (TUR).

Russia has been steadily isolated from the global economy. The ruble has been hammered against the dollar. Interestingly, Russia doesn’t have that much debt relative to GDP. Their problem is that they can’t turn to financing from foreign investors. That means much of their investment must come from inside, i.e. from spending targeted for something else.

I want to be clear that these problems aren’t much of a threat to us and our Buy List. If anything, our conservatism is probably helping us when compared to the chaos of these economies. The major Emerging Markets ETF (EEM) is down about 20% from its January high.

There tends to be a familiar script with financial crises. A country borrows too much. At some point, the bond market has had enough. Bond yields soar, and the currency tanks. That leads to political upheaval as inflation takes hold and the central bank raises rates to defend the currency. There are a zillion different permutations, but that’s the general idea. The only way to solve the mess is by making hard decisions. You can’t cheat debt investors forever.

We should keep an eye on these issues. So far, I doubt they’ll continue to spread, but when markets turn manic, you never know where it will end. Now let’s look at some recent news impacting our stocks.

Buy List Updates

Checking the archives, I see that I haven’t written about Snap-on (SNA) recently. This is a terrible oversight on my part that shall be rectified immediately. The stock has been a workhorse lately. Since early May, shares of SNA are up over 30% for us.

In July, SNA gapped up after an impressive earnings beat. For Q2, they raked in $3.11 per share. That was up 20% from last year, and it beat expectations by 16 cents per share. I was especially pleased to see a 0.3% increase in operating margins.

I think the story with Snap-on is a pretty simple one: folks got way too pessimistic. The stock got beat down in the early part of this year. To be fair, I shared some of the pessimism, but not to enough to scare us out of the stock. I had been particularly concerned about some weakness in their tool division. However, the rising economy seems to be alleviating that issue. I didn’t think this would happen so soon, but SNA is now up 6.8% this year.

Snap-on is due to report Q3 earnings in another month. Wall Street currently expects $2.85 per share. That’s an increase of 16% over last year. Even after Snap-on’s nice run, the stock is still going for less than 16 times this year’s earnings estimate. I also expect to see another dividend increase from Snap-on in early November. In the last five years, SNA’s dividend has more than doubled. This week, I’m raising my Buy Below price on Snap-on to $196 per share.

Snap-on made a new 52-week high on Thursday, as did several other Buy List stocks; Danaher (DHR), Hormel Foods (HRL), Fiserv (FISV), Check Point Software (CHKP) and Sherwin-Williams (SHW). Also, RPM International (RPM) and Church & Dwight (CHD) came very close to new highs, but fell just short.

I’ll quietly note that our problem-child stock, Ingredion (INGR), has been improving. I’m still disappointed with their performance this year, but we’ll learn a lot more soon when they report Q3 earnings. On a strict valuation basis, Ingredion looks tempting, but I want to make sure there are no more surprises.

Another problem stock that’s improved lately is Alliance Data Systems (ADS). The stock started out terribly this year, but it turned a corner in May. The recovery had been going smoothly until mid-July when ADS got slammed for a 10% loss after a poor monthly business update. (For the record, I didn’t think it was that bad.) The Q2 earnings report was pretty good and ADS stood by its full-year forecast. ADS eventually rallied again, and on Thursday, the stock touched a seven-month high.

I used to joke that there’s probably a great investing strategy to be gleaned by investing in our most beaten-down stocks. There may be some truth to that. The reason is that our stocks tend to be very high quality. Even when they fall from Wall Street’s favor, the fall often doesn’t last long.

That’s all for now. Next week should be fairly quiet for economic news. However, I’ll be on the lookout for the housing-starts report which is due out Wednesday morning. Then on Thursday, we’ll get existing-home sales and the jobless-claims report. The following week should be more eventful as the Federal Reserve has a two-day meeting. Expect to see another rate increase from the central bank. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

P.S. Dividend and income expert Tim Plaehn—whose articles and research I’ve been sharing with you over the past few months—is hosting a live interactive discussion on using his Disruptive Dividends strategy to boost your returns with little effort. He’s even going to show how to get dividend-like yield from stocks that don’t pay dividends. Toward the end of the discussion he’ll give us four actionable trades and then wrap up with a live Q&A. The event is on Wednesday, September 26th, and I’ve arranged for free registration for Crossing Wall Street readers. Click here for details.

Posted by Eddy Elfenbein on September 14th, 2018 at 7:08 am

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.

- Tweets by @EddyElfenbein

-

-

Archives

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His