CWS Market Review – September 7, 2018

“The natural-born investor is a myth.” – Peter Lynch

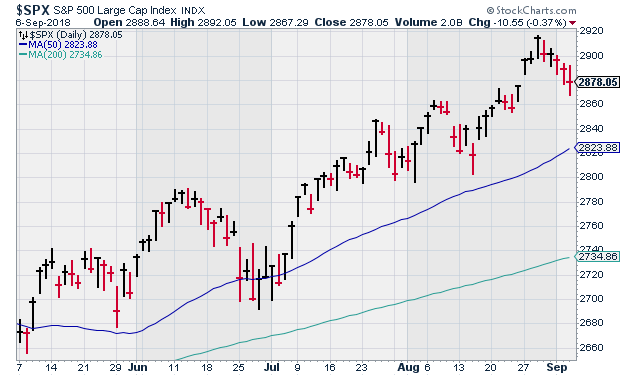

Perhaps I should take newsletter breaks more often. While I was out relaxing, the stock market bounced up to another all-time high. Last week, the S&P 500 broke above 2,900, the Nasdaq Composite breached 8,000 and the Dow got over 26,000.

The stock market has pulled back a bit since then, but I’m pleased to report that our 2018 Buy List is at a new high. Our Buy List is now up 9.28% YTD (not including dividends), and we’ve outpaced the overall market by a decent margin since the beginning of August. Best of all, we still haven’t made a single change to our portfolio this year. As usual, a little patience combined with low turnover and high-quality stocks wins the race.

In this week’s CWS Market Review, I want to highlight some recent economic news. The good news is that there’s good news. In fact, I don’t see any major economic troubles headed our way in the near term. Still, this isn’t a time to be complacent. I’ll also bring you up to speed on news impacting our Buy List stocks. (We now have eight stocks that are up more than 19% this year!) Before we get to that, let’s look at some recent optimistic economic news.

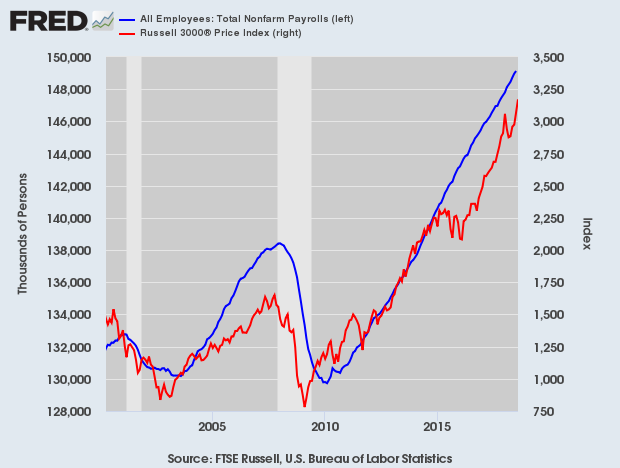

Jobless Claims Fall to a 49-Year Low

Later today, the government will release the employment figures for August, and I suspect it will be another good report. Nonfarm payrolls will probably be about 180,000, give or take. There’s even a chance that the unemployment rate could dip down to a multi-decade low. It’s not so outlandish. On Thursday, the jobless claims report came in at 203,000, which is the lowest number since December 1969. This week’s ADP report showed an increase in private payrolls of 163,000 during August. That was a bit lighter than expectations.

We also had two economic reports this week that really surprised me. On Tuesday, the ISM Manufacturing Index came in at 61.3. That’s the strongest number in 14 years. I like to pay attention to this report for two reasons. It comes out on the first business day of the month. A lot of key economic reports come after a generous lead time. I prefer getting the info fast. Also, the ISM Index has a good track record of lining up with recessions. I’ve found that any number around 45 or below usually signals a recession. We’re not even close.

On Thursday, we got a look at the ISM Non-Manufacturing Index, which came in at 58.5. That’s also very good, and it’s up 2.8 from July. I was curious to see how the bond market would react, but it seems as quiet as ever. The yield on the 10-year Treasury is still below 2.9%. I’d be concerned by any sudden jump in bond yields.

When we look at the stock market to see if it’s too expensive, the first question to ask is “compared to what?” A good proxy, in my opinion, is the 10-year TIPs. That’s the inflation-protected bond. The 10-year TIPs currently yield just 0.80%. I’ve found that the stock market performs well as long as the 10-year TIPs yield less than 2.43%. I’m not claiming that’s an iron rule for markets, but it’s a good reminder that higher stock valuation can be justified with lower bond yields.

On the Friday before Labor Day, the government revised Q2 GDP growth up to 4.2%. That’s only a slight change from the original report, which was 4.1%. How does Q3 look? That’s tough to say just yet, but it could be pretty good. The Atlanta Fed now says it expects Q3 GDP growth of 4.4%.

The bottom line for us is that the economy continues to do well. I’d be concerned if bond yields were rising or the housing market was breaking down, but we’re not there yet. This is also an excellent environment for corporate profits. Investors should continue to focus on a diversified portfolio of high-quality stocks such as you’ll find on our Buy List. Two names that look particularly good right now are Torchmark (TMK) and Alliance Data Systems (ADS). And remember to pay attention to our Buy Below prices!

Welcome the Communications Services Sector

There’s an important change coming soon to Wall Street. Standard & Poor divides the S&P 500 into 11 different sectors. This is a handy way to keep track of what’s doing well and what isn’t. The problem is these sectors kinda match reality, but not exactly. Personally, I’ve never liked the Telecommunications Sector. It’s basically AT&T and Verizon, and that hardly makes a sector.

Apparently, someone at S&P agrees with me. They’ve decided to rebrand Telecom as the Communications Services Sector. The change will go into effect at the close of business on September 28. The new sector will have AT&T and Verizon, plus some big-name stocks will be migrating there from other sectors. For example, Facebook, Google and Netflix will go in. So will Disney. Also, the Information Technology Sector will now be known as the Technology Sector. S&P will divide the Communications Services Sector into two industry groups: Media & Entertainment and Telecommunications.

These changes may sound like an overly technical part of investing, and to some extent, they are. However, there’s an important lesson for investors here. How does a company describe what business it’s in? That’s not as simple as it looks. With modern investing, a company’s industry is becoming harder to pin down.

When I was a kid, AT&T was the phone company. Ma Bell. Now AT&T owns Time Warner. So what industry are they in now? I dunno. Media? Maybe. Entertainment? I guess. Content? I really don’t know. The same can be said of Disney, which now owns Fox. The world has changed, and both of those companies have to compete with their digital rivals. As a result, the precise definition for what they do is blurred. This is more common than many investors realize. The business world is in constant flux, and you should always remember that an innovation can upend the ways things have always been. Now let’s look at some of our Buy List stocks.

Buy List Updates

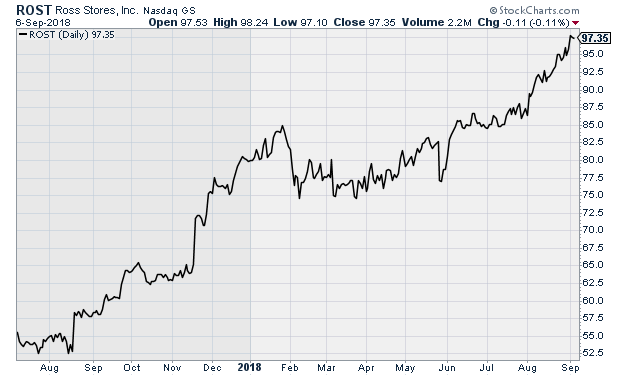

Speaking of lessons, here’s a good one on why we focus on high-quality stocks and ignore short-term drama. In our last newsletter, I discussed the fiscal Q2 earnings report from Ross Stores (ROST). The numbers were quite good, and as usual, Ross gave conservative guidance. I wasn’t bothered at all.

I didn’t know what the market’s reaction would be, but we had a clue since Ross was down 5%, placing it near $90 per share in Thursday’s after-hours market. Of course, that’s just after-hours; there’s no law that says that’s where the stock will open.

In the newsletter, I said that reaction “seems overdone to me.” I was right. The stock gapped up and down after the earnings report, but it’s now settled down, and Ross is well above where it was prior to the earnings report. On Thursday, shares of ROST got as high as $98.24 per share, which is a new all-time high.

This has been a very good stock for us. Last August, I told you that Ross is “a good value here.” The stock is up nearly 80% since then. This week, I’m raising our Buy Below on Ross to $104 per share.

A few small items. JM Smucker (SJM) completed the divestiture of its Pillsbury baking division. That brings in $375 million for Smucker. There were two recent merger deals involving our Buy List stocks. Moody’s (MCO) said they’re buying Reis (REIS), a firm that deals in real-estate data. It’s an all-cash deal that values Reis at $278 million or $23 per share. The deal is expected to close in Q4.

Also, Stryker (SYK) is buying K2M Group Holdings (KTWO) at $27.50 per share. That works out to $1.2 billion. KTWO is a big player in the spinal biz. According to the WSJ, “Stryker said the deal wouldn’t affect earnings this year. It expects to report adjusted earnings of $7.22 to $7.27 this year.”

Of the 25 stocks on our Buy List, two stocks had quarters that ended in August: RPM International (RPM) and FactSet Research (FDS). These will be our only two earnings reports until the Q3 earnings season gets going in mid-October. FactSet is due to report on September 25. On Thursday, shares of FDS hit a new all-time high of $233.71. This week, I’m lifting our Buy Below on FactSet to $242 per share. RPM International hasn’t said yet when they’ll report, but it will probably be around October 3.

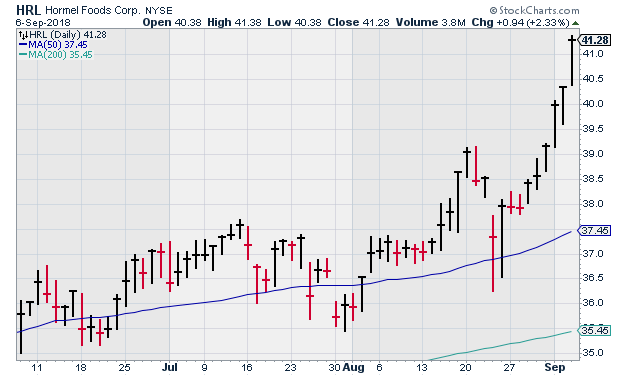

Hormel Foods (HRL) did almost an exact repeat of Ross Stores, only perhaps more so. Two weeks ago, the stock dropped 3% after its earnings report. It’s up more than 10% since then, including six up days in a row. On Thursday, Hormel hit another new high. I’m lifting my Buy Below on Hormel Foods to $44 per share.

In addition to Ross Stores, FactSet and Hormel, we also had new highs on Thursday from Church & Dwight (CHD), Fiserv (FISV) and Sherwin-Williams (SHW).

That’s all for now. The August jobs report is due out later this morning. I expect to see more good results, but we need to see better numbers on wages. There’s not much in the way of economic reports next week. On Wednesday, the Beige Book comes out. On Thursday, the CPI figures are released. So far, inflation has been largely contained. I suspect this will continue. The retail-sales report comes out on Friday. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

Syndication Partners

I’ve teamed up with Investors Alley to feature some of their content. I think they have really good stuff. Check it out!

3 Recession Proof High-Yield Dividend Stocks

As the stock market indexes continue with history’s longest bull market, investors are becoming concerned that the bull is on its last legs and they need to start preparing for the next bear market. I am not predicting the end of the bull market. Nobody can. What you can do is start to add stocks to your portfolio that are more resistant to economic recession and stock market bear markets.

It’s important to understand that a stock market bear market will take down the value of all stocks, with very few exceptions. The companies you want to own are the ones whose businesses will continue to operate, generate strong revenue, and grow through a recession or bear market. These companies can continue to pay dividends and the share prices will recover after the down turn. You as an income focused investor continue to collect dividends while other investors worry about how they are going to recover from their losses.

Our search for recession/bear market resistant dividend stocks focuses on the business operations. We want companies whose operations should at least stay level and hopefully thrive in all economic conditions. These will be more conservative income stocks, with the trade off of lower current yields. Here are three for your further research.

Buy These 3 Growth Stocks on Robinhood and Pay NO Commission

As editor of Growth Stock Advisor, I’m always on the lookout for disruptors…trends that will change forever the way things are done. And of course, the companies that are at the forefront of the disruption and that will benefit from it.

One such disruption is occurring right now in my former field of employment – the brokerage industry and commission-free trading. It is perhaps apropos that the first disruptor in the sector is a company called Robinhood, which sent shockwaves through the brokerage industry in 2015 when it launched, offering free stock trades.

Robinhood is adding 250 ADRs (American depositary receipts of companies from Japan, China, Germany, the U.K. and elsewhere. ADRs are stocks of foreign companies that trade and settle in the U.S. market in dollars, allowing investors to avoid having to transact in a foreign currency. Here are three ADRs that I like right now….

Posted by Eddy Elfenbein on September 7th, 2018 at 7:08 am

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.

- Tweets by @EddyElfenbein

-

-

Archives

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His