CWS Market Review – November 22, 2019

“The whole problem with the world is that fools and fanatics are always so certain of themselves, and wiser people so full of doubts.” – Bertrand Russell

So true, Berty. Consider this scenario: If someone told you that come November, there would be impeachment hearings in Congress, and violent street demonstrations in Chile, Iran and Hong Kong, what would the stock market be doing?

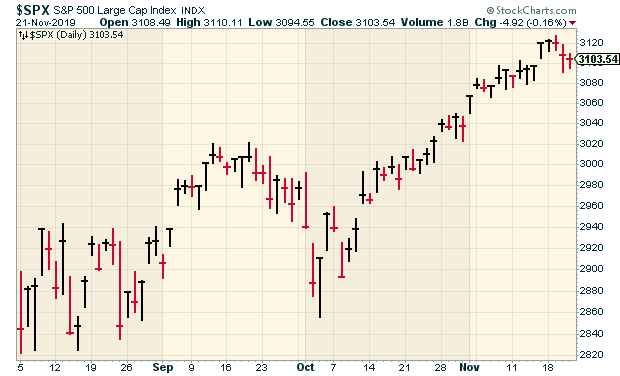

Well, we know that answer. It’s as calm as ever. In fact, the S&P 500 has made several new all-time highs recently. The stock market has once again entered one of its somnolent rally phases.

Here are some facts. In the 19 trading days ending on Monday, the S&P 500 closed higher 15 times. Many of those daily gains were tiny. In fact, the 20th day was broken by a decline of just 0.05%. The S&P 500 hasn’t had a daily drop of more than 0.4% in six weeks. In 10 of the last 13 days, the S&P 500 has closed, up or down, by less than 0.28%. Compare that to August when it happened just four times in 22 days.

In this week’s issue of CWS Market Review, I’ll discuss Jay Powell’s apparent victory over the bond market. I’ll also cover the strong earnings report we just got from Ross Stores. Plus, we have upcoming earnings from Hormel and Smucker. But first, let’s take a closer look at how the Federal Reserve has prevailed against the doubters.

Jay Powell Faced the Bond Market and Won

On Wednesday, the Federal Reserve released the minutes of its most recent meeting. This was the meeting where the Fed decided to cut interest rates. That was its third rate cut in three months.

First, I have to explain that reading the Fed’s minutes involves taking a deep dive into the artful use of indefinite pronouns. The minutes never say who said what. Rather, we’re told that “many” said this, or “several” countered that. “Some” and “a few” make frequent appearances as well.

These last minutes were important because they suggested that the Fed may be done with cutting interest rates. If so, that’s very good news. It also is a big victory for the Fed, and particularly for Fed Chairman Jay Powell.

Last year, the Fed had been consistently hiking rates, but gradually this year, the market started to call for rate cuts. As I’ve pointed out before, the two-year Treasury is a good proxy for Fed policy. As a very general rule, the central bank doesn’t like to get too far from the two-year yield. As that yield started to plunge, the Fed had to act.

This meant that the Fed had to withstand a lot of criticism, especially from President Trump. Still, despite what the president said (and tweeted), he couldn’t do anything to stop them. There were also many doubters on Wall Street. I know a lot of folks were expecting several more rate cuts. We were told that the Fed would be out of bullets by the time of a real emergency. However, Powell consistently said that these were “mid-cycle adjustments.”

The Fed was also able to do something that large organizations have a tough time doing: it admitted it made a mistake. Mind you, the Fed never came out and said so, but its actions certainly suggest that its last few hikes were wrong.

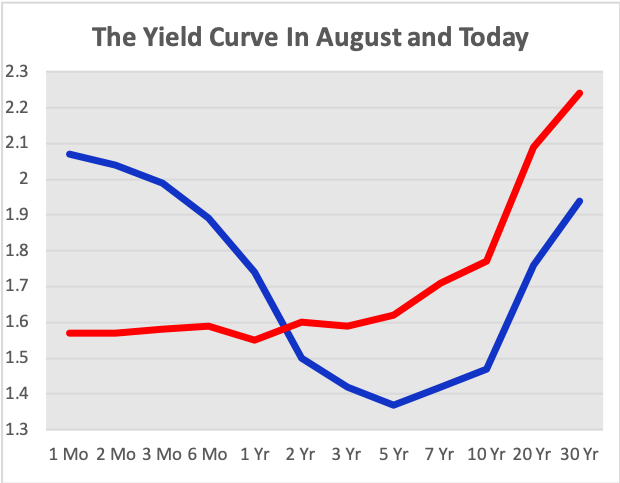

Now here we are a few weeks later, and the bond market has chilled out. The yield curve is no longer inverted. The stock market has made several new highs, and volatility is quite low. The Fed meets again in December, and the market doesn’t foresee any change to interest rates. At least, not for another eight months, and even at that point, it’s barely in favor of a rate cut.

To show you how much things have changed, here’s the bent-up yield curve from August 28 (blue) and the more normal one from November 21 (red).

We’re also seeing better news from the housing market. At this time last year, new-home sales dropped sharply, but this week’s report was quite good. This is key for the Fed. Housing is important for the economy, but the Fed has an indirect hand over the industry when it moves interest rates. The difficulty is that there tends to be a lag time.

This week, Freddie Mac said that the 30-year fixed-rate average fell to 3.66%. That’s a six-week low. A year ago, it was at 4.81%. That bodes well for housing and construction-related stocks. For example, Sherwin-Williams (SHW) made another new high last week. It’s a 44% winner for us this year.

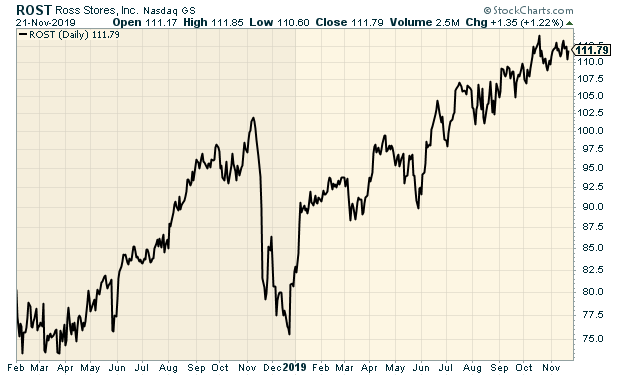

Now let’s look at the big earnings beat we got from Ross Stores.

Ross Stores Beats and Guides Higher

After the bell on Thursday, Ross Stores (ROST) reported fiscal Q3 earnings of $1.03 per share. That easily beat the company’s own forecast range of 92 to 96 cents per share. Ross always gives low guidance and most always beats it.

Quarterly sales were up 8%, but the really impressive stat was comparable-store sales. For Q3, that was up 5%. That’s very good. The company had been expecting a gain of 1% to 2%.

Barbara Rentler, Chief Executive Officer, commented, “We are pleased that our third-quarter results were ahead of expectations. Operating margin of 12.4% was also above-plan mainly due to better-than-expected sales and merchandise margin.

Looking ahead, Ms. Rentler said, “As we enter this year’s holiday season, we are up against multiple years of strong comparable-store sales gains. In addition, we expect another fiercely competitive retail landscape, along with ongoing uncertainty surrounding the macroeconomic and political environment. As such, while we hope to do better, we continue to project fourth-quarter comparable-store sales gains of 1% to 2%, versus a 4% increase last year.”

I like that operating-margin number. Again, Ross almost always says it sees comparable-store sales growth of 1% to 2%. I’m pretty confident that they can top that. Remember that Q4 is the biggie for Ross. That covers November, December and January.

Ross now expects Q4 earnings of $1.20 to $1.25 per share which includes a tax benefit of two cents per share. So Ross is keeping its Q4 guidance the same, but it effectively is higher guidance because it incorporates the beat for Q3. Before, Ross expected earnings this year of $4.41 to $4.50 per share. Now they see earnings of $4.52 to $4.57 per share. That’s up from $4.26 per share last year.

This was a very good quarter for Ross. I’m raising our Buy Below to $118 per share.

Earnings Preview for Smucker and Hormel

We have two more earnings reports this month. This is for companies with quarters that ended in October.

JM Smucker (SJM) is due to report later today. The last earnings report was a dud. For the August quarter, comparable net sales fell 4%, and earnings fell 11% to $1.58 per share. That was 16 cents below expectations.

What went wrong? The company was hurt by poor sales in its pet-foods business. Smucker owns Milk Bone and Meow Mix. In recent years, the company has been working to build up this business. That’s why they bought Ainsworth, but the competition has been stronger than they thought. Management has conceded the difficulties in this sector. Smucker’s coffee business was weak last quarter as well.

Previously, the company was expecting sales to rise by 1% to 2%. Now they expect sales to be flat to -1%. Smucker had been expecting full-year earnings of $8.45 to $8.65 per share. Now they see earnings of $8.35 to $8.55 per share. Wall Street expects fiscal Q2 earnings of $2.13 per share.

Hormel Foods (HRL) is due to report on Tuesday, November 26. This will be for their fiscal Q4. Like Smucker, this has been a tough year for Hormel. In May, the Spam people lowered their full-year guidance due to African swine fever and other issues. I think that rattled investors.

The August earnings report was a relief, and Hormel stood by its full-year forecast for earnings of $1.71 to $1.85 per share. Since Hormel has already earned $1.33 through the first three quarters, the guidance implies a range for fiscal Q4 of 38 to 52 cents per share. Hormel also sees full-year sales of $9.5 billion to $10 billion. Wall Street expects 46 cents per share.

After that, we only have one more earnings report this year. FactSet (FDS) is due to report on December 19. RPM International (RPM) has a November quarter, but it will report earnings in early January. Soon after that, Q4 earnings seasons will begin.

That’s all for now. There will be no newsletter next week. I’m taking my traditional Thanksgiving break. The U.S. stock market will be closed on Thursday for Thanksgiving, and it will close at 1 p.m. on Friday, November 29. On Wednesday, the government will update its report on Q3 GDP. The initial report showed growth of 1.9%. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

Posted by Eddy Elfenbein on November 22nd, 2019 at 7:08 am

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.

- Tweets by @EddyElfenbein

-

-

Archives

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His