CWS Market Review – April 10, 2020

There is every reason to believe that the economic rebound, when it comes, can be robust.” – Fed Chairman Jerome Powell

The stock market is closed today for Good Friday. Traditionally, this is the one day of the year when the stock market is closed while the government and most businesses are open. Of course, this year, many businesses are closed anyway.

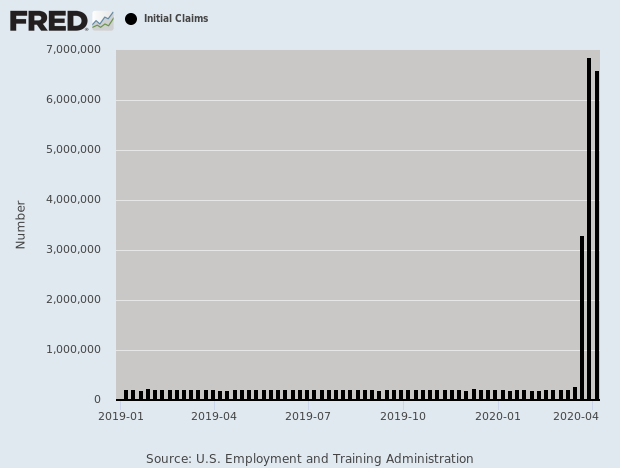

The economic news continues to be dire. On Thursday, the Labor Department reported that first-time jobless claims hit 6.6 million. That means that over the past three weeks, nearly 16.8 million Americans have lost their jobs. That’s roughly 10% of the entire workforce.

Despite the terrible economic news, the stock market has roared back to life. There appears to be tentative news that the social isolation policies are having an impact. Of course, there’s still a long way to go. Markets are celebrating, and it may be premature. This past week was the best for stocks since October 1974. We’ve now made back half of what we lost.

Monday’s percentage gain for the Dow was its sixth best in the last 87 years but only its third best in the last month. Over the last 13 sessions, the S&P 500 gained 24.7%. That’s an astounding gain for such a short amount of time. Our Buy List has done even better, gaining 27.6%. Some individual stocks have done spectacularly well (off a very low base). Shares of AFLAC (AFL) are 65% above their low from just three weeks ago. In the last four days, Trex (TREX) has gained 26%.

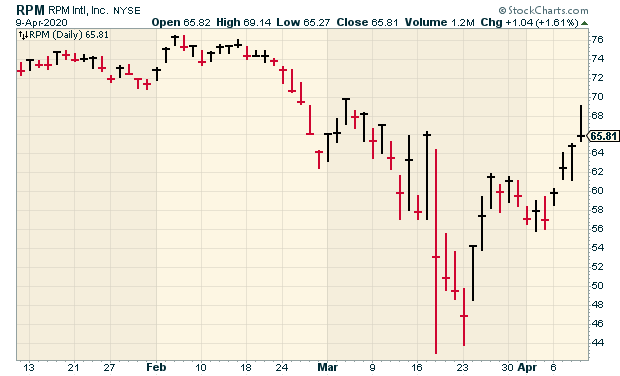

In this week’s issue, I want to look closer at the market’s rebound. Is it for real, or is it just another head-fake? I’ll also discuss the unprecedented measures the Fed announced on Thursday. We also had a good earnings report from RPM International (RPM). The company beat earnings, and the shares are up more than 15% in the last four sessions. I’ll also update you on some news impacting our Buy List stocks. But first, let’s look at the market’s impressive rebound.

Don’t Be Taken In By This Rally

I’ve tried to caution you against getting too impressed by the market’s snap-back. Whenever the market gets killed, there’s naturally going to be a counter-rally. Bear-market rallies are a fact of life, and they can easily fool investors into thinking the bears have run off for good. Still, I have to give this latest surge its due. If this is a “dead-cat” rally, then it’s one darned impressive cat.

Ryan Detrick notes that in two of the past three weeks, the S&P 500 has gained more than 10%. To put that in perspective, these two weeks now rank in the top six of all weeks going back to World War II.

Just to give you an example of how strong the rally has been, the S&P 500 Energy has gained 43% since March 23. Of course, that’s after an historically awful period before that. (Get used to seeing a lot of “since March 23.”)

I have to confess that I have mixed feelings about the rally. It’s nice to see, and it’s been very good to us. But I don’t trust it, and I’m not alone. It’s interesting to note that the Volatility Index remains quite elevated. At one point on Tuesday, the S&P 500 was up by 3.5%, yet it closed down for the day. The market is putting a lot of weight on the improved coronavirus numbers.

It’s especially odd to see rising share prices in the face of such poor economic news. Janet Yellen said GDP could fall by 30%, and unemployment is already at 12% to 13%.

Last Friday’s jobs report showed a loss of 701,000 jobs, and that’s only through March 12. It’s been much worse since then. Goldman Sachs floated a simple formula. Every 1.5 million in excess jobless claims reflects a 1% hit to GDP. If that’s right, that translates to a knock of 11% to GDP, and we’re not done yet.

On Thursday, the Federal Reserve unveiled a massive $2.3 trillion program. The central bank is willing to take unprecedented steps to protect the financial system from economic wreckage. The Fed’s balance sheet is now over $6 trillion.

There are several programs involved, and one includes the Fed’s buying high-yield bond ETFs. One popular high-yield ETF, HYG, jumped over 6.5% on Thursday. Some of Ford’s bonds went from 71 cents on the dollar to 89 cents. The carmaker has $36 billion in bonds outstanding.

Investors should continue to focus on high-quality stocks. I won’t predict that the rally will soon run out of steam, but it’s prudent to act as if that’s possible. Our stocks are holding up well. Four of our stocks are up for the year, and another seven are down less than 6%. Silgan (SLGN), one of our new stocks this year, came very close to a fresh 52-week high on Thursday.

I like all the stocks on our Buy List, but Hershey (HSY), Ansys (ANSS) and Church & Dwight (CHD) look particularly good here. We’ll know a lot more once earnings season begins. Most importantly, don’t panic and sell. These surges can come at any time. Now let’s look at our one earnings report this week.

RPM International Beats Earnings

On Wednesday, RPM International (RPM) reported fiscal third-quarter earnings of 23 cents per share. That beat estimates by two cents per share. This is for the three months ending on February 29, so it was before the coronavirus become a major business issue.

Previously, RPM said it expected EPS “in the high-teens to low-20-cent range.” Three weeks ago, RPM revised that to say it expects to see earnings “at the higher end” of its previous range. They were right on that.

For Q3, adjusted EBIT rose 30.4% to $60.5 million, and net sales increased by 2.9% to $1.17 billion. Due to the coronavirus, RPM has decided to suspend its guidance. They’re also canceling any share buybacks. In a tough time like this, that’s the right thing to do.

On the bright side, RPM made it clear that it’s “well positioned to weather the pandemic due to strong balance sheet, significant liquidity, maintenance nature of products, potential for DIY uptick, and margin improvements from restructuring.” At the end of the quarter, RPM has a position of cash and revolving credit of $1.14 billion.

RPM’s business is divided into four groups. For Q3, Construction Products had a sales increase of 4.7%. Performance Coatings rose by 1%. The Consumer Group was up 5.4%. Specialty Products, the smallest group, was the laggard as organic sales fell 7.1%.

RPM’s Chairman and CEO Frank C. Sullivan said:

“We are pleased with our top-line growth during the third quarter, which typically generates our most modest results each year because it falls during the winter months, when painting and construction activity slow. Market-share gains and pricing contributed to organic-sales growth of 3.0%. This was partially offset by foreign-currency translation of 0.8%, while acquisitions contributed 0.7% to sales. Our year-to-date cash flow from operations improved by $236 million over last year due to better working-capital management and margin improvement from our MAP to Growth program.”

For the nine months so far of this fiscal year, RPM increased sales by 2.1% to $4.05 billion. Organic growth is up 2.0%, acquisitions added 1.3% and foreign exchange reduced sales by 1.2%. For the first nine months of the year, RPM earned $1.94 per share.

Now comes the hard part. The previous full-year guidance, which is now canceled, was for earnings between $3.30 and $3.42 per share. RPM said it expects to see a sales drop for Q4 of 10% to 15%.

This was a good earnings report, and it shows us what a good company RPM is. Since March 23 (see!), RPM has gained more than 40% for us. The company owns Rust-Oleum and makes lots of workshop products. RPM has raised its dividend every year since 1973. This week, I’m lowering our Buy Below on RPM to $71 per share.

Buy List Updates

First-quarter earnings season is about to begin. I have some of the earnings dates, but not all of them. I hope to have a complete calendar for you next week. Twenty-one of the 25 stocks on our Buy List follow the March/June/September/December reporting cycle.

Here are some updates on our Buy List stocks. I’m lowering a few of our Buy Below prices to better reflect the current market.

Ross Stores (ROST) furloughed most of its employees starting on April 5. The board and CEO have agreed to go without a salary. Ross has said there will be no change to employees’ health benefits. That’s good to see. Hopefully, the stores will reopen soon. On Monday, the stock jumped 16%. Ross is a buy up to $100 per share.

Ansys (ANSS) released a letter to shareholders. There’s too much news to give a decent summary, but the company said it will continue to pay its salaried employees. I’m dropping my Buy Below to $250 per share.

I mentioned earlier that AFLAC (AFL) has rallied 65% off its low from three weeks ago. Of course, that’s after a nasty downturn. The next earnings report is due out on April 29. I’m dropping AFLAC’s Buy Below to $42 per share.

This week, Disney (DIS) said that its Disney+ streaming service has surpassed 50 million subscribers. The service is just five months old, and it’s on pace to hit its 2024 target this year. Earnings should be out in early May. Disney remains a buy up to $107 per share.

Two months ago, I raised our Buy Below on Fiserv (FISV) to $130 per share. The company had just announced its 34th consecutive year of double-digit earnings growth. The reasons were good, but my timing was terrible. I still love Fiserv, but I’m dropping my Buy Below to $107 per share.

Stryker (SYK) is another stock that’s loving the rebound. Since March 23 (again!), SYK is up 45% for us. Earnings are due out on April 30. I’m dropping my Buy Below down to $200 per share.

Shares of Trex (TREX) have been all over the place. The good news is that the stock has gained 26% in the last four days. Earnings are due out on May 4.

That’s all for now. There’s not much on tap for economic news next week. The Thursday jobless-claims report seems to have taken over as the most-watched economic release. On Wednesday, we’ll get the reports on retail sales and industrial production. The first Q1 earnings report will be coming out, although ours won’t start until the following week. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

Posted by Eddy Elfenbein on April 10th, 2020 at 7:08 am

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.

- Tweets by @EddyElfenbein

-

-

Archives

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His