CWS Market Review – October 23, 2020

“Pride of opinion has been responsible for the downfall of more men on Wall Street than any other factor.” – Charles Dow

Earnings season is finally here, and it’s shaping up to be a very good one for our Buy List. This week, we had six earnings reports, and five of them topped Wall Street’s expectations. The other one met expectations.

We also got a nice 11% dividend hike from Stepan. This is the 53rd year in a row that Stepan has increased its dividend. By the way, did you see the price spike in Eagle Bank? Our favorite little bank demolished Wall Street’s expectations. For Q3, Eagle earned $1.28 per share. The consensus on Wall Street had been for 81 cents per share. In the last month, Eagle has rallied 26%.

Silgan Holdings beat and raised guidance. Danaher had a solid earnings report, and the shares jumped to another new all-time high. We now have a 52% gain in Danaher this year.

Let’s keep the good news coming. In this week’s issue, I’ll sum up all of the recent earnings news. I’ll also preview the nine Buy List earnings reports we have coming next week. There’s a lot to get to, so let’s jump right in.

Six Buy List Earnings Reports this Week

Here’s an updated look at our Earnings Calendar.

| Stock | Ticker | Date | Estimate | Result |

| Eagle Bancorp | EGBN | 21-Oct | $0.81 | $1.28 |

| Globe Life | GL | 21-Oct | $1.75 | $1.75 |

| Silgan | SLGN | 21-Oct | $0.95 | $1.04 |

| Stepan | SCL | 21-Oct | $1.40 | $1.56 |

| Check Point Software | CHKP | 22-Oct | $1.53 | $1.64 |

| Danaher | DHR | 22-Oct | $1.36 | $1.72 |

| AFLAC | AFL | 27-Oct | $1.13 | |

| Fiserv | FISV | 27-Oct | $1.16 | |

| Sherwin-Williams | SHW | 27-Oct | $7.75 | |

| Cerner | CERN | 28-Oct | $0.71 | |

| Church & Dwight | CHD | 29-Oct | $0.67 | |

| Intercontinental Exchange | ICE | 29-Oct | $0.99 | |

| Moody’s | MCO | 29-Oct | $2.10 | |

| Stryker | SYK | 29-Oct | $1.40 | |

| Broadridge Financial Sol | BR | 30-Oct | $0.63 | |

| Trex | TREX | 2-Nov | $0.37 | |

| Ansys | ANSS | 4-Nov | $1.26 | |

| Becton, Dickinson | BDX | 5-Nov | $2.52 | |

| Hershey | HSY | 6-Nov | $1.70 | |

| Disney | DIS | 12-Nov | -$0.71 | |

| Middleby | MIDD | TBA | $1.02 |

Let’s start with Stepan (SCL). On Wednesday, the chemical company reported earnings of $1.56 per share for Q3, which beat Wall Street’s consensus of $1.40 per share. The company also raised its dividend by 10.9%, making it the 53rd annual dividend increase in a row. The quarterly dividend will rise from 27.5 cents to 30.5 cents per share. That makes the yield a little over 1%.

The company has three operating groups. Sales at the Surfactant unit rose 11% to $333.8 million. Polymer sales dropped by 14% to $116.7 million, and Specialty Products dropped by 17% to $14.0 million. The Surfactants have been a life-saver for Stepan this year. I guess during a pandemic everyone wants to keep their hands clean.

I’m lifting our Buy Below on Stepan to $120 per share.

Next up is Silgan (SLGN). The container company had a solid quarter. For Q3, Silgan made $1.04 per share. That’s up 37% over last year’s Q3. Wall Street had been expecting 95 cents per share.

The metal-containers business saw volume growth of 17% thanks to more folks eating at home. The closures business was helped by increased demand for household cleaning products. Their plastic-containers business had volume growth of 14%.

Best of all, Silgan raised its full-year guidance range to $2.92 to $2.97 per share. The previous range was $2.70 to $2.85 per share. Last year, Silgan made $2.16 per share.

For Q4, Silgan now expects earnings of 47 to 52 cents per share. They made 38 cents per share for last year’s Q4.

CEO Tony Allott said, “While we are still completing our annual budget process for 2021, at this time we anticipate overall operating earnings for the Company remaining at these strong levels.”

The stock dropped after the earnings report. Bank of America lowered SLGN to “neutral.” I’m not too worried. To reflect the price drop, I’m lowering our Buy Below to $40 per share.

After the closing bell on Wednesday, Globe Life (GL) reported Q3 operating earnings of $1.75 per share. That matched Wall Street’s estimates.

Some of the details look quite good. ROE this year is running at 9.4%. Since the pandemic started, Globe has seen a big increase in Life claims.

In August, Globe Life resumed its share-repurchase program. During Q3, the company bought back 1.4 million shares for a total cost of $118 million. That’s an average share price of $81.79.

Globe Life sees full-year earnings of $6.84 to $7.00 per share. For 2021, GL expects earnings to range between $7.30 and $7.80 per share. Wall Street had been expecting $7.47 per share. There’s not much else to say. This is a good company that’s doing what I expected. The shares gained 2.8% on Thursday. Globe Life remains a buy up to $90 per share.

Eagle Bancorp (EGBN) may be the big star for us this earnings season. After the bell on Thursday, Eagle reported Q3 earnings of $1.28 per share. That crushed Wall Street’s estimate of 81 cents per share. For last year’s Q3, Eagle made $1.07 per share.

This was a very good quarter for Eagle. Most importantly, legal costs didn’t take a big bite out of earnings. Eagle’s assets topped $10 billion. The bank’s efficiency ratio, which is a measure of how well the bank is keeping a rein on expenses, is 38.1%. That’s quite good.

At the end of the quarter, book value per share was $37.96. For Q3, net legal expenses related to the investigation were $957,000. Nonperforming assets were 0.62% of total assets. Net interest margin came in at 3.08%.

The stock gapped up over 5% on Thursday. I’m cautiously raising our Buy Below on Eagle to $33 per share.

We had two more earnings reports on Thursday. Danaher (DHR) reported Q3 earnings of $1.72 per share. That’s up 62% from last year’s Q3. The consensus on Wall Street was for earnings of $1.36 per share.

This year’s results are impacted by the addition of Cytiva. That’s the new name for GE’s biopharma business, which Danaher bought last year. For Q4, Danaher expects revenue growth, excluding Cytiva, in the low-single digits.

Danaher’s CEO said, “We delivered outstanding third-quarter results, achieving double-digit revenue growth, over 60% adjusted EPS growth, and we more than doubled our free cash flow year-over-year.

The shares rose 3.3% on Thursday to reach another all-time high. I’m raising our Buy Below to $250 per share.

Check Point Software (CHKP) said it made $1.64 per share for Q3. That’s 11 cents more than Wall Street’s consensus. Quarterly revenue rose 4% to $509 million.

Gil Shwed, the CEO, said, “We executed well in the third quarter and delivered another successful virtual quarter. Revenues grew in all key areas, with security subscriptions growing by 10%, and EPS grew by 14% year over year. We saw expanded customer adoption of Quantum Network Gateways, CloudGuard, Infinity Total Protection and Beyond the Perimeter (BTP) – endpoint and mobile security solutions.”

The cyber-security firm said it’s seen an increase of coronavirus vaccine-related hacks. Back-to-school domains has also been a major theme for the bad guys.

For Q4, Check Point expects earnings to range between $2.00 and $2.18 per share and revenues to be between $525 million and $575 million. Shwed said that given the higher level of uncertainty, the company needed to have a guidance range that’s wider than normal.

The Street’s consensus was for $2.09 per share on revenues of $555 million. Check Point remains a buy up to $133 per share.

Nine Earnings Reports Next Week

Next week is going to be very busy with nine Buy List stocks scheduled to report earnings. Three stocks are due to report on Tuesday, October 27.

AFLAC (AFL) is usually pretty good at giving guidance, but they held off this time for obvious reasons. The duck stock had a solid Q2. AFLAC earned $1.28 per share which was 21 cents ahead of estimates. The CEO did say that AFLAC is committed to defending its dividend streak of 37 consecutive annual hikes. For Q3, Wall Street expects earnings of $1.13 per share. AFLAC should be able to top that.

Fiserv (FISV) is having a rare off-year for us. Since it’s been such a strong stock for so long, I’m willing to give it some leeway.

In August, Fiserv reported Q2 earnings of 93 cents per share. That matched Wall Street’s view. Fiserv said it expects EPS to grow by at least 10% this year. For context, Fiserv made $4.00 per share last year. This would be Fiserv’s 35th year in a row of double-digit adjusted earnings growth. It’s currently down 13% this year.

Fiserv is down 11.5% for us this year. Wall Street expects earnings of $1.16 per share.

Sherwin-Williams (SHW) has been a surprise winner for us this year. The stock has more than doubled off its March low.

The paint folks creamed estimates for Q2. Sherwin also raised its full-year range to $19.21 to $20.71 per share, which includes $2.54 per share in acquisition-related amortization expense. The previous range was $16.46 per share to $18.46 per share, including a $2.54 per share acquisition-related amortization expense.

For Q3, the company sees net sales up or down in the low single digits. The consensus on Wall Street is for $7.75 per share.

Cerner (CERN) is due to report next Wednesday. For Q3, the healthcare-IT firm expects revenue to range between $1.35 billion and $1.40 billion, and they expect full-year revenue between $5.45 billion and $5.55 billion. The latter range is a downgrade from their previous guidance.

For earnings, Cerner expects Q3 to range between 70 and 74 cents per share. For the whole year, they see earnings between $2.80 and $2.88 per share. The previous range was $2.78 to $2.90 per share.

Over the last few months, shares of CERN have traded in a fairly wide range that seems to center on $68 to $72 per share, or thereabouts.

We have four more earnings reports due out on Thursday. Let’s start with Church & Dwight (CHD). The household-products company is managing itself well during the pandemic. Sales last quarter rose by 10.6% to $1.19 billion. The CEO said this was an “extraordinarily strong quarter,” and I have to agree. C&D now expects full-year sales growth of 9% to 10% and EPS growth of 13%. Wall Street is looking for earnings of 67 cents per share.

Intercontinental Exchange (ICE) made headlines recently with its $11 billion purchase of Ellie Mae, a mortgage-services provider. This is a big deal.

The key to understanding ICE’s business is that it’s all about data. It’s a good business to be in. Their operating margin is usually about 60%.

The company doesn’t provide EPS guidance, but ICE did say it expects Q3 data revenue between $575 million and $580 million. The consensus on Wall Street is for EPS of 99 cents.

Moody’s (MCO) had an outstanding quarter for Q2. The ratings agency earned $2.81 per share which beat estimates by 60 cents per share.

In fact, the results were so good that Moody’s significantly raised its earnings guidance. Moody’s now sees full-year earnings of $8.80 to $9.20 per share. That’s up from the previous forecast of $8.15 to $8.55 per share.

For Q3, Wall Street expects Moody’s to earn $2.10 per share. I think it will be a lot more.

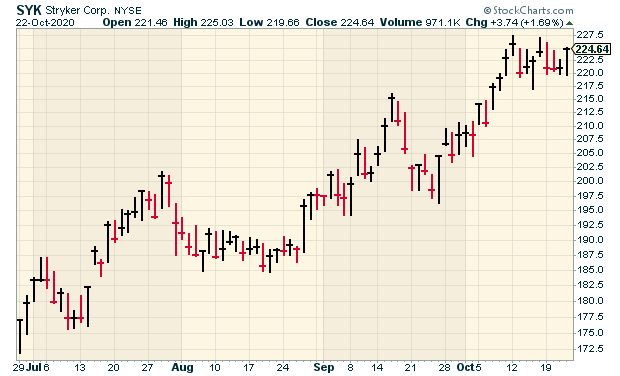

Stryker (SYK) had a tough quarter during Q2. Earnings dropped by two thirds, but the company still made a profit, and it beat estimates.

Stryker is in a tough spot since the business environment is so poor for them. Still, it’s a solid and well-run outfit. For the long term, I’m not worried about Stryker. In fact, the shares recently made a new all-time high. The consensus for Q3 is for $1.40 per share. If that’s right, it’s a profit drop of more than 25%.

Broadridge Financial Solutions (BR) tends to be one of our quieter stocks, but don’t overlook it. In August, we saw a nice earnings beat from them. I especially like the recurring revenues numbers.

For the new fiscal year, which ends on June 30, Broadridge expects earnings growth of 4% to 10%. Since the company made $5.03 per share last year, breaking out the math, that implies earnings this year between $5.23 and $5.53 per share.

Broadridge also recently hiked its dividend for the 14th year in a row. The earnings report is due out on Friday. Wall Street expects earnings of $1.02 per share.

That’s all for now. Lots more earnings next week, but there will also be some key economic reports. On Monday, the existing-home-sales report is due out. On Tuesday, we’ll get the report on durable goods. Wednesday will be our first look at Q3 GDP growth. The annualized number could be over 30%. It will most likely by the highest on record. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

P.S. I’m hosting an after-market call this Tuesday with Professor Nicole Boyson of Northeastern University. Please join us. You can register at this link.

Posted by Eddy Elfenbein on October 23rd, 2020 at 7:08 am

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.

- Tweets by @EddyElfenbein

-

-

Archives

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His