CWS Market Review – April 11, 2014

“Individuals who cannot master their emotions are ill-suited

to profit from the investment process.” – Benjamin Graham

That’s so true. I’ve always thought that if things didn’t work out for Mr. Spock at Starfleet, he would have made a killer value investor. Once again, emotions boiled to the surface on Wall Street this week. Most specifically, the emotion of fear. On Thursday, the S&P 500 lost 2.1%, and the Nasdaq Composite dropped 3.1% for its worst day since 2011. Those two got off easy compared with the Nasdaq Biotech Index, which plunged 5.6%.

Having heard those numbers, you´d probably think the economic news on Thursday was terrible. Not at all. The Department of Labor reported that initial claims for unemployment insurance dropped to their lowest level in seven years. In other words, the jobs market is getting better. On Tuesday, we learned that jobs openings climbed to a six-year high. So why are traders so upset?

In this issue of CWS Market Review, I’ll walk you through Wall Street’s latest panic attack, and more importantly, I’ll tell you what to do about it. I’ll also cover the disappointing earnings guidance from Bed Bath & Beyond, and I’ll preview IBM’s earnings report for next week. This is a crucial time for the market; U.S. corporations are sitting on $1.64 trillion in cash, the Federal Reserve is winding down an unprecedented experiment on the economy and earnings season is upon us. But first, let’s see why Value is beating the stuffing out of Growth.

The Current Sell-Off Is about Valuation, Not the Economy

If it feels like it was less than a week ago that the S&P 500 touched an all-time intra-day high, that’s because it was. From the big-picture perspective, the drop in the past week hasn’t been that much—just under 3%. But what makes it interesting is that the pain hasn’t been evenly distributed.

Here’s what investors need to understand: The current sell-off has been focused on valuation, not on economically-sensitive areas. This is important. Many of the richly valued, raging-bull stocks have been clobbered, while their more reasonably-priced cousins have barely been touched. Stocks like Gilead and Amazon are more than 20% below their 52-week highs.

Some observers have said that that the tech sector has been hit hard, but that’s not quite right. It’s been the big-name and richly-valued tech stocks like Facebook, Twitter and Tesla that have been taken down. But more sensibly valued names like Apple or Buy List favorite IBM have done just fine. Some of our favorite tech stocks like Oracle, Microsoft and Qualcomm have outpaced the Nasdaq over the last several sessions.

We can also see the effect by looking at the environment for Initial Public Offerings. That’s probably the most emotion-based part of the market. Not too long ago, investors were eager to snatch up whatever IPO Wall Street was throwing their way. Not anymore. La Quinta, the hotel franchise, was recently priced below expectations. Ally Financial flopped on its first day of trading, and King Digital, the Candy Crush people, was another disappointment.

We have to remember that the stock market has rallied for five straight years, so naturally investors grow complacent. As the bull market rages, we typically see shares in companies long on promises and short on results grab most of the gains. Now we’re witnessing a swift reaction.

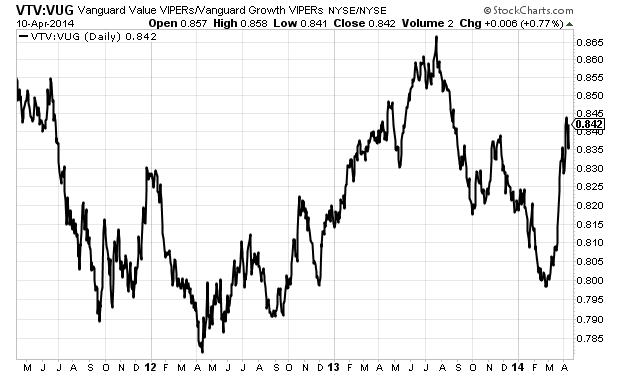

What’s been happening is that the market is shifting from favoring Growth stocks to favoring Value stocks. (One effect of this shift is that large-cap is beating small-cap, but that’s the tail, not the dog.) This shift didn’t surprise me, but its pace and magnitude did. As a proxy for Growth and Value, I like to look at the ETFs run by Vanguard. Since February 25, the Growth ETF ($VUG) has lost 3.8%, while the Value ETF ($VTV) has gained 1.2%. That may sound small, but it’s a dramatic turn for such a short period of time and for such broad categories. Here’s a look at the VTV divided by the VUG. Notice how sharp the spike has been.

Now investors have been flocking to areas of safety (dividends, earnings, strong brands). For example, the S&P 500 Utilities Sector ($XLU) has been one of the top-performing market sectors. This is a direct reaction to the Fed’s policies because folks want to lock in those rich yields before rates go up.

Speaking of which, probably most surprising to many market watchers has been the strength in the bond market, especially at the long end. The yield on the 20- and 30-year Treasuries recently dropped to their lowest levels since July. The Long-Term Treasury ETF ($TLT) has been beating up the stock market this year. The long-term yields were already low, and they’ve gotten lower. The TLT is up 7.8% this year, while the S&P 500 is in the red.

A stronger shift from Growth to Value doesn’t worry me. On balance, it’s good for our Buy List. I would be much more concerned if I saw a rapid deterioration in many cyclical sectors. For example, the Homebuilders ($XHB) have been down, but nowhere near as severely so as the biotechs. The S&P 500 Industrials ($XLI) are also down, but largely in line with the rest of the market. That’s important because the market doesn’t see a broad industrial decline (at least, not yet). Some cyclicals, like our very own Ford, have actually led the market in recent days.

Overall, I think this newfound skepticism is healthy for investors. They’re questioning some of these rich valuations. Later on, I’ll talk about the news from Bed Bath & Beyond, but let’s put this in its proper context. BBBY’s bad news is that their earnings would be as high as we expected. Still, they have no debt, lots of cash and a strong cash flow. Compare that with Twitter, which is expected to make a total profit this year of one penny per share. Twitter´s profit margin for Q4 was -210%. In other words, they spent three times what they took in. So you can understand why investors might have second thoughts about that valuation. As Mr. Spock might say, “it’s only logical.” Now let’s look at some opportunities for bargain hunting in this market.

What to Do Now

Obviously, the first thing investors should do is not panic. For disciplined investors, times like this are your friends. This is also a good time for investors to focus on fundamentals. Not only are dividends in demand, but I think they’re going to be more demand as the year goes on.

We have several stocks on our Buy List with strong dividends, and prospects for even higher dividends. Let’s start with Ford Motor ($F), which increased its dividend by 25% earlier this year. The sales report for March was quite good. The earnings report for Q1 might not be so good, but that’s due to environment, not Ford. The company is improving its operations in Europe. Plus, General Motors has had some high-profile issues of late. The stock is going for eight times next year’s earnings. Ford currently yields 3.2%, and I rate it a very good buy up to $18 per share.

Another solid dividend Buy Lister is Microsoft ($MSFT). Thanks to their new CEO, for the fist time in a generation, Microsoft is hip. The last two earnings reports were quite good, and I’m looking for another one later this month. Last September, Microsoft increased its dividend by 22%. We should see another healthy increase later this year. The stock currently yields 2.8%. Microsoft remains a solid buy up to $43 per share.

I’m writing this to you on Friday morning, ahead of the first-quarter earnings report from Wells Fargo ($WFC). The bank just won approval to raise its dividend by 16.7%. They have plenty of room to raise the dividend even more next year. Wells currently yields 2.9%. WFC is an excellent buy up to $54 per share.

McDonald’s ($MCD) was one of the few stocks that rallied yesterday. That probably has a lot to do with its rich dividend. MCD currently yields 3.3%, which is a good deal in this market; that’s more than a 20-year Treasury. The fast-food chain is working hard to revamp itself. Look for a good earnings report the week after next. MCD is a good buy up to $102 per share.

Bed Bath & Beyond Is a Buy up to $71 per Share

On Wednesday, Bed Bath & Beyond ($BBBY) reported fiscal Q4 earnings of $1.60 per share. The home-furnishings store had said that earnings should come in between $1.57 and $1.61 per share. Clearly, this was a weak quarter for them. BBBY estimates that the lousy weather took six to seven cents per share off their bottom line.

The details weren’t encouraging. Quarterly sales dropped 5.8% to $3.203 billion. Comparable-store sales, which is the key metric for retailers, rose 1.7%. For the full year, BBBY made $4.79 per share, which is up from $4.56 in the year before.

As I’ve mentioned before, the poor Q4 numbers were expected, but I was curious to hear what they had to offer for guidance. For Q1, BBBY expects earnings to range between 92 and 96 cents per share. The consensus on Wall Street was for $1.03 per share. For the year, they expect earnings to rise by “mid-single digits.” If we take that to mean 4% to 6%, then their guidance works out to a range of $4.98 to $5.08 per share. Wall Street had been expecting $5.27 per share.

I’m not pleased with this guidance. The shares took a 6% cut on Thursday. Still, we should focus on some positives; BBBY is a well-run outfit, and they’ve been in tough spots before. The balance sheet is very strong, and they’ve been buying back tons of shares (though at higher prices). I’ll repeat what I said last week: don’t count these guys out. Bed Bath & Beyond remains a good buy up to $71 per share.

Expect Good Earnings from IBM

IBM ($IBM) is slated to report earnings after the closing bell on Wednesday, April 16. In January, Big Blue beat consensus by 14 cents per share, but a lot of that was driven by cost-cutting. Quarterly revenues fell 5.5% to $27.7 billion. That was $600 million below forecast, and it was the seventh-straight quarter of falling sales.

Here’s how I see it: IBM is at a crossroads right now. Much of the world is shifting to cloud-based networks, and a lot of people think IBM is being left behind. But IBM isn’t sitting still. The company is moving towards the cloud, and they’re getting rid of their lower-margin businesses. For example, they recently sold their server business to Lenovo for $2.3 billion. This may surprise a lot of people, but IBM’s cloud revenue rose by 69% last quarter.

For 2013, IBM earned $16.28 per share. They made a bold prediction saying that they expected to earn at least $18 per share this year. Still, Wall Street seems dubious. The consensus for 2014 earnings has slid from $18 per share a few months ago to $17.85 per share today.

For the first time in a long time, the stock is doing well (see above). On Thursday, IBM came close to trading over $200 per share for the first time in nine months. For Q1, Wall Street had set the bar low. Very low. The current consensus is for earnings of $2.54 per share, which is a decline of 15% from last year’s Q1. My numbers say IBM should beat that. I also expect IBM to raise its dividend later this month. The current dividend is 95 cents per share, and I think Big Blue could bump it up to $1.05 per share. The stock is going for about 11 times their own estimate for this year’s earnings. IBM remains a good buy up to $197 per share.

That’s all for now. Next week we’ll get important reports on inflation and industrial production, plus the Fed’s Beige Book (by the way, that’s a great resource for looking at the economy). The stock market will be closed next Friday for Good Friday. This is usually the one day of the year when the market is closed but most government offices are open. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

Posted by Eddy Elfenbein on April 11th, 2014 at 7:42 am

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.

- Tweets by @EddyElfenbein

-

-

Archives

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His