CWS Market Review – February 7, 2023

(This is the free version of CWS Market Review. If you like what you see, then please sign up for the premium newsletter for $20 per month or $200 for the whole year. If you sign up today, you can see our two reports, “Your Handy Guide to Stock Orders” and “How Not to Get Screwed on Your Mortgage.”)

Friday’s Jobs Report Signals More Rate Hikes

The stock market got a nice 1.3% bounce today. This comes after losses on Friday and Monday. Once again, High Beta stocks did the heavy lifting. The S&P 500 High Beta Index was up over 2% today while the S&P 500 Low Volatility Index was up just 0.01%.

On our Buy List, shares of Fiserv (FISV) soared more than 8.3% thanks to a good earnings report. I’ll have more details on that and on other stocks on our Buy List in Friday’s premium issue.

Last Friday, the government reported that the U.S. economy created 517,000 net new jobs in January. This was a shock to Wall Street since economists had been expecting an increase of only 187,000 jobs. The unemployment rate fell to 3.4% which is the lowest since May 1969.

While certain sectors of the economy appear weak, the labor market continues to be remarkably strong. In previous cycles, there’s been talk of “jobless recoveries.” Now we appear to be experiencing “growthless hiring.” Of course, the pace of inflation may explain some of that.

We’ve heard news recently of layoffs in the tech sector, but those job cuts apparently haven’t had a major impact on the overall numbers. Last year, nearly five million new jobs were created. That includes 260,000 new jobs in December. In the January jobs report, the so-called U-6 rate, which is a broader measure of unemployment, increased to 6.6%, but that’s still quite good.

Americans are also seeing a little better pay. Wages rose by 0.4% last month. Over the past year, wages are up by 4.4%. Unfortunately, inflation continues to eat into wage increases. According to the government, there are still 11 million job openings which is about two for every unemployed person.

In previous jobs reports, there were hints that the labor market could be slowing down. For example, temporary hiring declined, but all those signs disappeared in the January jobs report.

Looking at the details of the jobs report, leisure and hospitality jobs increased by 128,000. That was the largest advance for any sector. Business services added 82,000. Government increased by 74,000. Health care added 58,000 jobs. Retail increased by 30,000 and construction added 25,000 jobs.

Here’s the major impact of Friday’s jobs report: it complicates the job for the Federal Reserve. The Fed has steadily increased interest rates to slow down the economy, and by extension, slow down inflation. While inflation appears to be improving, the labor market isn’t cooperating.

Prior to the jobs report, futures traders had saying been that there would be one more small rate hike next month. Since the jobs report, traders now see an additional 0.25% increase in May. That would bring the Fed funds target rate to a range of 5.00% to 5.25%.

According to futures prices from late this afternoon, traders set a 91% chance of a 0.25% rate hike at the Fed’s next meeting on March 22. That sounds right. Traders also see a 72% chance of another 0.25% hike at the Fed’s May meeting. That’s up from 35% one week ago.

Fed Chairman Jerome Powell spoke today at the Economic Club of Washington. He said that the strong labor rate is a reason why the Fed thinks it faces a tough battle to defeat inflation.

I don’t think Wall Street is fully on his side. Many economists assume there’s a trade-off between employment and inflation (the Phillips Curve), but what if there’s not? Or maybe that relationship assumes other factors that may not be currently at work? We’re soon going to learn if disinflation can comfortably co-exist with a strong labor market.

Speaking of the jobs report, Powell said that it was “stronger than anyone I know expected.” Powell added, “It kind of shows you why we think this will be a process that takes a significant period of time.”

The C in FOMC stands for committee and so far, no one has broken ranks. The last policy statement was unanimous. That may soon change. Powell said, “So we think we’re going to have to do further [rate] increases, and we think we’ll have to hold policy at a restrictive level for some time.” I would not be surprised to see some Fed officials start to dissent from more rate hikes.

When the Fed updated its economic forecasts in December, not one member of the FOMC saw the Fed cutting rates sometime this year. Futures traders still think that’s a likely outcome later this year. In fact, a significant number of Fed members think short-term rates will rise above 5.25%.

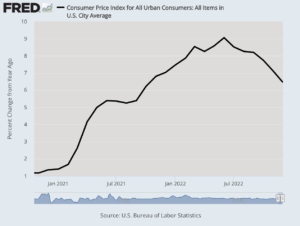

One important event coming next week could tell us more about future Fed policy. Next Tuesday, the government will release the CPI report for January. A lot of folks quibble with the government’s numbers. I try to focus on the overall trend of inflation, and that’s been in the right direction. The year-over-year inflation rate has declined for the last six months in a row. I think there’s a good chance we’re going to see #7 next week.

Unfortunately, this has not been a good earnings season for Wall Street. According to the latest stats I’ve seen, half the companies in the S&P 500 have reported earnings. Of those, 70% have beaten estimates. That may sound good but it’s below the five-year average of 77%. Earnings are only 0.6% above estimates. The five-year average has been 8.6%.

For revenues, 61% of companies have beaten revenue estimates. The five-year average has been 69%. Total revenues are coming in 1.1% above estimates. For the entire earnings season, we’re on track for revenue growth of 4.3% and for an earnings decline of 5.3%.

This comes on top of pre-earnings season in which analysts already pared back their earnings estimates. In other words, companies are barely beating earnings which have already been lowered.

This may not be over. We’re now seeing analysts cut back on their estimates for Q1, and the quarter isn’t quite halfway over. Historically, the largest downward revisions come during the first month of the quarter. In January, analysts lowered their estimates by 3.3%. The consensus of Wall Street analysts is that the S&P 500 will report earnings of $52.41 per share. That’s down from $54.20 at the start of the year.

Stock Focus: UFP Technologies

Before I get to this week’s stock focus, I want to update you on some stocks we talked about recently. Two weeks ago, we looked at United States Lime & Minerals (USLM).

After the close on Friday, USLM reported very good earnings for Q4. Since no one follows the stock, I made a rough estimate for $1.60 per share. I wasn’t even close. As it turns out, US Lime made $1.90 per share for Q4, and $8 per share for the entire year.

This means the stock is going for less than 20 times trailing earnings. The shares rose 1.9% yesterday, and that’s on top of gains on Thursday and Friday. In the last five months, USLM is up 45%. It’s hard for me to believe that Wall Street continues to ignore stocks like this.

Another stock we discussed was Old Dominion Freight Line (ODFL). I highlighted the stock on January 17. I said that it was due to report earnings on February 1, and Wall Street was expecting $2.68 per share. I wrote, “I think Old Dominion can beat that.” Well, I got that one right. The company earned $2.92 per share, and the shares jumped more than 10% on the day of the earnings report. ODFL is up nearly 30% this year.

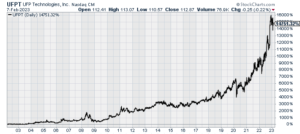

Now let’s turn to this week’s stock which is UFP Technologies (UFPT). In a little over 20 years, the stock has increased nearly 150-fold. That’s enough to turn $7,000 into over $1 million.

I’m not going to say that UFPT is completely ignored by Wall Street. A grand total of two Wall Street analysts cover the stock. UFPT is a medical devices company based in Newburyport, Massachusetts.

In its own words:

UFP Technologies is an innovative designer and custom manufacturer of components, subassemblies, products, and packaging primarily for the medical market. Utilizing highly specialized foams, films, and plastics, we convert raw materials through laminating, molding, radio frequency welding and fabricating techniques. We are diversified by also providing highly engineered solutions to customers in the aerospace & defense, automotive, consumer, electronics, and industrial markets.

UFPT’s next earnings report will probably be out in early March.

The last earnings report was very strong. For Q3, organic sales grew 21.7% and operating income increased 36.6%. Earnings rose 173% to $1.36 per share. The consensus, such as there was one, was for 94 cents per share.

CEO R. Jeffrey Bailly said, “Overall, it’s a very exciting time at UFP. We are seeing a sharp increase in customer orders, and our proactive investments to increase capacity have come online at just the right time. This, combined with the resolution of several supply chain issues, has enabled us to meet the surging demand.”

The stock is currently going for 24 times trailing earnings which is high but not excessive, especially if you consider how strong the earnings have been.

That’s all for now. I’ll have more for you in the next issue of CWS Market Review.

– Eddy

P.S. If you want to learn more about the stocks on our Buy List, please sign up for our premium service. It’s $20 per month, or $200 per an entire year.

Posted by Eddy Elfenbein on February 7th, 2023 at 7:18 pm

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.

-

Archives

- March 2026

- February 2026

- January 2026

- December 2025

- November 2025

- October 2025

- September 2025

- August 2025

- July 2025

- June 2025

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His