Posts Tagged ‘MOG-A’

-

CWS Market Review – November 7, 2014

Eddy Elfenbein, November 7th, 2014 at 7:10 am“Experience is the name everyone gives to their mistakes.” – Oscar Wilde

The stock market rally isn’t showing any signs of slowing down. On Thursday, the S&P rallied to yet another new all-time high. The index finished the day at 2,031.21 for its eleventh daily gain in the last 16 trading sessions. The Dow Jones Industrial Average hit its 21st record close of the year.

The S&P 500 is now up 9.9% on the year. Of course, nearly every penny of that has come in the last three weeks. On October 15, the S&P 500 was up just 0.76% on the year. I continue to be impressed by the market’s resiliency. On Wednesday, the S&P 500 along with the Dow Industrials, Dow Transports and Dow Utilities all closed at record highs. That hasn’t happened in more than 16 years.

Our Buy List continues to do well, but I have to face the fact that we’re most likely going to underperform the market this year, though not by much. The last time we trailed the market was 2006. Through Thursday, our set-and-forget Buy List is up 6.3% on the year which is about 3.6% points behind the overall market.

The big news this week was the mid-term elections. The Republicans took over the U.S. Senate and they look to have a generational high in the House. There’s been a lot of “what this means” chatter, most of it is sadly mistaken. I’ll give you my thoughts in a bit. I’ll also highlight the last batch of earnings reports. We had some strong reports from Moog and Cognizant, but Qualcomm was our big dud. I’ll run through the details. I’ll also bring you-up-to-speed on the last economic reports. But first, let’s look at how the shakeup in Washington affects our portfolios.

What the GOP Wave Means for Investors

Richard Nixon was once asked what he would do if he weren’t president. Nixon said that he’d probably be down on Wall Street buying stocks. That led one old-time Wall Streeter to say that if Nixon weren’t president he, too, would be buying stocks.

I live a few blocks from the White House and I’m guessing President Obama didn’t have an enjoyable evening on Tuesday night. The Republicans rolled up some impressive victories. We don’t have all the results in yet, but it appears that the GOP will have 53 seats in the Senate and about 250 seats in the House. The latter figure will be their best showing in 86 years. The Republicans also did quite well at the state and local levels.

So what does this all mean for the stock market and our portfolios? Honestly, it doesn’t mean much. One of the great myths about the stock market is that it cares about politics. It’s just not so. By politics, I mean the daily back-and-forth between the two major parties. The market is mostly non-partisan although there are some exceptions.

Let me be clear that the government policy does impact the economy, and by extension, the stock market. But those policy decisions are usually well removed from the standard partisan debate. Of course, what the Federal Reserve does is important, but that’s rarely an election issue. Plus, there’s no reason to think that a change on Capitol Hill will have a great impact on monetary policy.

Mitch McConnell, the new Senate majority leader, quickly made it clear that there would be no government shutdown; nor would he try to abolish all of Obamacare. The government shutdown is a good example of a partisan effort that riled investors, but even that didn’t last long.

One issue that may be positive for our Buy List is an attempt by Congress to repeal the medical device tax. This impacts companies like Medtronic, Stryker and CR Bard. Interestingly, all of those stocks did well on Wednesday. This week, I’m also raising some Buy Below prices for our healthcare stocks (details to follow).

If the American people gave the Radical Marxist Socialist I Hate My Parents party a big majority in Congress, then sure, it would change things. But let’s remember that 89 senators from last session will be returning next year. What we call a big shakeup is when there are 11 new faces. Of course, that’s exactly how the system was designed. The changing passions of the people are supposed to be muted in the halls of government. Contrast that with Wall Street which is nothing but the passion of the people. Or at least, of traders.

I see too many investors let their political leanings interfere with their investments. That’s a bad move. The stock market has done well under both parties and it’s done poorly under both parties. Trying to build an investing strategy based on politics misses what truly drives the market.

There are some people who claim that DC gridlock is good for the market because nothing gets done. Perhaps, but that’s a very minor factor. The stock market will continue to be driven by the fundamentals. That’s why I talk so much about earnings. A lousy stock can rally on terrible earnings. Or in the case of Amazon, not much earnings at all. But a company with decent earnings will eventually do well. It just takes some patience.

Speaking of earnings, let’s look at this earnings season. We’re nearing the end of Q3 earnings season and 80% of companies in the S&P 500 have topped expectations while 61% have topped their sales estimates. Those are good results, but again, these companies are beating reduced estimates.

Wall Street continues to be buoyed by the Strong Dollar Trade. In Europe, Mario Draghi is increasingly frustrated with the Continent’s sluggish economy. He’s willing to follow more unconventional policies to get the European economy back on its feet. That probably means he won’t mind seeing the euro drift lower. The euro just fell to a two-year low against the dollar. We’re also seeing the same thing in Japan. All of this is propelling the dollar higher.

Investors need to understand the impact of the Strong Dollar Trade because that’s been the dominant theme in the markets. The price of gold seems to be in freefall. (Silver, too.) Energy stocks can’t catch a break. Oil is now below $78 per barrel. That’s down $25 per barrel in four months. Small-caps had a brief outperformance surge last month, but that seems to have passed. I should note that the relative performance of active managers tends to be strongly correlated with the relative performance of the small-cap sectors. Note that the Strong Dollar Trade isn’t necessarily good for the overall market. Rather, it makes its impact felt within the market.

The economic news was mixed this week. On the plus side, the ISM Manufacturing Index is still holding up well. The ISM for October was 59.0 which is tied for the best in the last three years. The bad news was that Construction Spending dropped 0.4% in September.

The October jobs report is due out Friday morning. Traditionally, the monthly jobs report has been the most important economic report on the calendar. While it’s still a biggie, I think it’s not quite as important as it used to be. I expect the October report to be a continuation of the trend that’s been in place for several months now, meaning about 200,000 to 250,000 new jobs each month. The ADP report said that the economy created 230,000 private sector jobs last month. Also, the initial claims reports have been quite strong. Now let’s look at some of our recent earnings reports.

Moog Soars to a New High

Shortly after I sent out last week’s CWS Market Review, Moog ($MOG-A) reported its fiscal Q4 earnings. The company had a very good quarter. For Q4, Moog earned $1.12 per share which was four cents better than estimates.

CEO John Scannell said, “Earnings were up and cash flow was very strong. Our financial position allowed us to buy back 4 million shares of stock. In a year with little top-line growth, our employees put in a tremendous effort to deliver on our commitments to both our customers and our investors and I thank them for their hard work and dedication. As we look forward, we are projecting a stronger fiscal ’15 with earnings per share of $4.25, up 21% from fiscal ’14 on sales growth of about 1%.”

For the fiscal year, Moog earned $3.52 per share which is an increase from $3.26 the year before. Additionally, Moog expects to make $4.25 per share this coming year. The shares have rallied impressively over the past few weeks. I’m raising my Buy Below on Moog to $78 per share.

Cognizant Rallies 21% in 13 Days

Our big star this earnings season was Cognizant Technology Solutions ($CTSH). The IT outsourcer raked in 66 cents per share last quarter which was seven cents better than estimates. Quarterly revenues jumped 11.9% to $2.58 billion.

For Q4, Cognizant sees earnings of at least 63 cents per share. Wall Street had only been expecting 59 cents per share. That would bring full-year earnings to at least $2.57 per share. CTSH also said they expect revenues to range between $2.61 and $2.64 billion. That was above the Street’s forecast of $2.59 billion. When CTSH was hit three months ago, it was due to concerns about their top-line growth.

“Revenue growth was slightly ahead of our revised forecast and, as expected, non-GAAP operating margins were within our target range of 19-20% as we absorbed the impact of annual wage increases during Q3,” said Karen McLoughlin, Chief Financial Officer. “Our balance sheet remains strong as cash and short term investments increased during the quarter by almost $500 million to $4.6 billion. Later this quarter, we anticipate utilizing $1.7 billion of this cash, in addition to $1 billion of floating rate debt through a syndicated term loan, to fund the previously announced acquisition of TriZetto.”

In the 11 days going into the earnings report, Cognizant rallied 11%. Then it jumped another 8% after the earnings announcement. It’s about time this stock got some love. I’m raising my Buy Below on Cognizant to $55 per share.

Qualcomm Disappoints

After IBM, we had been having a great run through earnings season, but Qualcomm ($QCOM) had to trip us up. The chipmaker reported fiscal Q4 earnings of $1.26 per share. That missed consensus by five cents per share. Revenue rose 3% to $6.69 billion which was below consensus estimates of $7.016 billion. The stock was dinged for an 8.6% loss on Thursday.

Let’s run through some numbers. For this quarter (ending in December), Qualcomm sees EPS ranging between $1.18 and $1.30. Wall Street had been expecting $1.43 per share. They expect sales to range between $6.6 billion and $7.2 billion.

The big headache for Qualcomm is their conflict with the Chinese government, and there’s not much the company can do. My guess is that the Chinese government will level a big fine on them, and they’ll have to pay it and move on. Qualcomm also disclosed that it’s facing anti-trust investigations by the FTC and by the EU.

For this current fiscal year (ending September 2015), Qualcomm expects earnings between $5.05 and $5.35 per share, and revenue between $26.8 billion and $28.8 billion. Wall Street had been expecting earnings of $5.58 per share on sales of $28.91 billion.

Let’s remember that Qualcomm has tons of cash, no debt and strong free cash flow. They’re not going broke anytime soon. Still, this was a painful report. I’m lowering my Buy Below price on Qualcomm to $75 per share.

DirecTV Is a Buy up to $90 per Share

DirecTV ($DTV) had another good quarter. The satellite-TV operator earned $1.33 per share for Q3 which was three cents better than estimates. Revenue came in at $8.37 billion which was $60 million better than estimates.

As I’ve mentioned before, shares of DTV and AT&T are basically joined at the hip. After AT&T’s poor earnings report, its shares fell below $34.90 which is the lower bound of the merger deal.

Here’s how it works: The merger deal calls for DTV shareholders to get $28.50 in cash, plus 1.905 shares of AT&T if that stock goes below $34.90. In simpler terms, if AT&T hits $34.90 or more, then the merger price for DTV is $95. Recently, AT&T fell as low as $33.10 per share. Fortunately, it’s recovered so that good for DTV. DirecTV remains a good buy up to $90 per share.

Buy List Updates

I also want to highlight a few more of our Buy List stocks. CA Technologies ($CA) and eBay ($EBAY) have bounced back impressively since mid-October. Shares of CA are up more than 16% since October 16.

Bed Bath & Beyond ($BBBY) continues to recover. On Thursday, the stock got as high as $69.98 per share. That’s a seven-month high! This is exactly why I like to stick with strong companies when they hit rough patches. I’m raising my Buy Below on BBBY to $72 per share.

Also in the retail sector, Ross Stores ($ROST) just touched a new 52-week high. Ross reports earnings later this month. I’m keeping our Buy Below at $83 per share.

Shares of Microsoft ($MSFT) just closed at a 14-year high. The stock has had an incredible run this year. The stock is now a 30% winner on the year for us. MSFT is a buy up to $50 per share.

Our healthcare stocks have been doing very well lately. I want to raise a few of our Buy Below prices. This week, I’m raising the Buy Below on Medtronic ($MDT) to $70 per share. I’m lifting CR Bard ($BCR) to $165 per share. I’m raising Stryker ($SYK) to $90 per share. Finally, I’m raising Express Scripts ($ESRX) to $80 per share.

That’s all for now. Next week should be mostly quiet. Most of the earnings reports are in, but we’ll get a few key economic reports. I’ll be most interested to see the Retail Sales report which comes out on Monday. With gas prices down, that gives consumers more money which they tend to spend quickly. This will also give us a hint of how optimistic shoppers are going into the all-important holiday shopping season. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

-

Big Beat for Moog

Eddy Elfenbein, July 26th, 2013 at 8:40 amMoog ($MOG-A) just reported earnings of 90 cents per share (the June quarter is their fiscal third). Wall Street’s consensus was for 84 cents per share. Sales rose 10% to $671 million.

Moog Inc. announced today third quarter sales of $671 million, an increase of 10% over last year’s $611 million. Net earnings of $34 million and EPS of $.75 were both lower as a result of asset write-downs totaling $.15 per share in the quarter. Excluding the effect of the write-downs, adjusted net earnings of $41 million were up 7% from last year and adjusted earnings per share of $.90 were 6% higher.

And now for guidance:

The Company modified its earnings per share guidance to $3.25 for the year ending September 2013. This includes $.15 per share in restructuring charges and $.15 per share in asset write-downs described previously. Sales are now forecast at $2.58 billion, up 5% year over year, with net earnings of $149 million.

The Company also provided its initial projections for fiscal 2014 with sales of $2.67 billion and earnings per share in a range of $3.90 to $4.10, a 23% increase at the mid-point of the range.

“This quarter had many moving parts,” said John Scannell, CEO. “Our underlying operations were strong and our restructuring efforts are paying off. We had two asset write-downs in the quarter — one in Medical and one in Industrial. In addition, we announced a strategic review of our Medical Devices segment. For the full year 2013, we are expecting our underlying operations to deliver $3.55 per share — a respectable performance given the challenges we have faced. We will have $.15 per share in restructuring and $.15 per share in asset write-downs so our bottom line for the year will be $3.25 per share. As we look forward to fiscal 2014, we believe we will see much stronger operating performance. We’re projecting a narrow range of outcomes for earnings and EPS. The midpoint would be earnings of $185 million, or $4.00 per share, a 23% increase.”

This is very good news. The Street had been expecting $3.39 per share for this year and $3.90 next year.

Moog is our #1 performer this year with a 39.5% gain YTD.

-

CWS Market Review – July 5, 2013

Eddy Elfenbein, July 5th, 2013 at 8:08 am“Do you know the only thing that gives me pleasure?

It’s to see my dividends coming in.” – John D. RockefellerThis will be an abbreviated issue of CWS Market Review. Trading this week was shortened due to Independence Day, and most of the fat-cat Wall Streeters are relaxing at their cribs in the Hamptons.

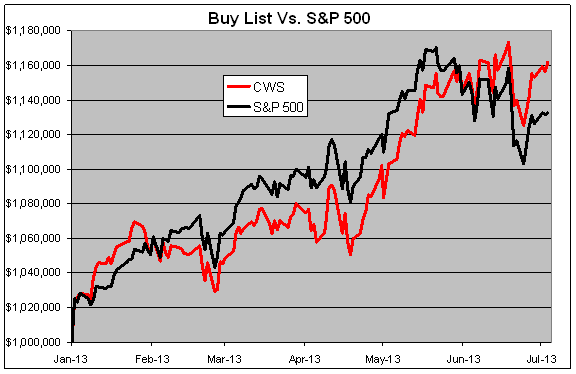

Don’t fear, my friends. My vigilant team and I are still on the watch, protecting you from whatever mayhem comes our way. The good news is that our Buy List continues to do very well. Through Wednesday, our Buy List is up 16.18% for the year compared with 13.27% for the S&P 500. That’s our widest lead all year.

In this week’s CWS Market Review, I’ll discuss the recent good news from Moog and Ford. Both stocks have been big winners for us lately. I’ll also talk about the upcoming Q2 earnings season. JPMorgan Chase and Wells Fargo will be our first stocks to report on Thursday, July 11th. But first, let’s look at why Ford just broke out to a new two-year high.

Good News for Ford and Moog

On Wednesday, shares of Ford ($F) closed at $16.43, which is the automaker’s highest close in 29 months. The catalyst for the move was a very strong sales report for June. Ford reported that sales were up 13% last month. The best news was that sales of F-150 pickups, which are a key moneymaker for Ford, jumped 24%. Ford said that sales in China are up 44% from last year. In May, China sales were up 45%. Ford has been busy playing catch up to GM in China.

Ford is due to report Q2 in a few weeks. The current estimate on Wall Street is for earnings of 36 cents per share, which would be a 20% increase over last year’s Q2. I should add that Ford has been creaming its estimates lately. I like this stock a lot. Ford remains a very solid buy up to $18 per share.

In last week’s CWS Market Review, I raised our Buy Below on Moog ($MOG-A) to $55 per share. That was pretty good timing! This week, Moog said that it’s looking at strategic options for its medical-devices division. That’s Wall Street-ese for “we’re looking to sell it.” I like when companies sell off units, and usually, so do investors. The stock broke $54 on the news, which is an all-time high.

The medical devices unit comprises just 5.7% of Moog’s overall business, but sales were down last year. As much as the market responds to the financial benefits of the divestiture, I think the market appreciates management’s willingness to shake things up. The company is due to report earnings at the end of the month. Wall Street currently expects earnings of 89 cents per share. Moog remains a good buy up to $55 per share.

Second-Quarter Earnings Season Begins Next Week

We’ve heard a lot of talk of how well companies should be doing, but beginning next week, we’ll finally see hard evidence of how well companies have performed. Earnings season is Judgment Day for Wall Street, and we’ll soon learn who’s been pulling their weight and who hasn’t. Fifteen of the 20 stocks on our Buy List ended their quarter on June 30th. This means that three-fourths of our portfolio will report earnings over the next month.

Wall Street is clearly nervous going into this earnings season. The analyst community currently expects index-adjusted earnings of $26.40 for the S&P 500. In the past year, that estimate has been revised downward by $2.50, including more than $1 in the last three months. Citigroup recently noted that negative pre-announcements have been outrunning positive ones by a ratio of 6.5 to 1. That’s the worst ratio since 2009, back when the world was falling apart.

I actually think the pessimists have gotten ahead of themselves here. While earnings expectations did need to come down, I suspect that growth is ramping up in several sectors. I especially think the damage from Europe won’t be as bad as is feared. The big trend recently has been share buybacks. For Q1, buybacks were up 17% from the year before. I think that will continue to be a major theme this year.

Our first two Buy List stocks to report this earnings season will be both of our big banks, JPMorgan Chase ($JPM) and Wells Fargo ($WFC). This is fortuitous for several reasons. First, both are excellent stocks. They’re also good bellwethers for the rest of the financial sector. Also, both banks made a decision recently to go all in on the mortgage business, which has been a huge winner for them. Both stocks are 20% winners for us this year.

JPMorgan had an insanely good first quarter. As much as Jamie Dimon annoys me, I have to admit that the bank still gets it done. Q1 earnings came in at $1.59 per share, which was 20 cents more than the Street’s consensus. There was some pushback from traders’ saying that the earnings beat was solely due to a tax benefit and some accounting adjustments.

But don’t let the bears scare you. JPM is doing very well. Wall Street expects Q2 earnings of $1.43 per share, and I think they’ll have little trouble beating that. Thanks to a pullback from the May high of $55.90, JPM is going for just 9.2 times this year’s earnings estimate. Jamie also recently raised the dividend by 26.7% to 38 cents per share. JPM currently yields 2.88%. The stock is an excellent buy up to $56 per share.

The business at Wells Fargo tends to be more stable than what we see at JPMorgan, and by extension, it tends to be more predictable. For Q1, Wells saw its earnings rise 22%, and they beat expectations by four cents per share. Their community banking division has been especially strong. Wells rewarded shareholders with a 20% dividend boost. Interestingly, the current yield is 2.91%, which is nearly the same as JPM.

For Q2, the Street expects 92 cents per share for Wells. That sounds about right, maybe a penny or two too low. The important thing for us to see is that business is continuing to improve. I also like that Wells and JPM took advantage of low rates to raise tons of cash from investors. Wells Fargo is a good buy up to $46 per share.

New Buy Belows for WEX and BBBY

I’m again going to raise my Buy Below on WEX Inc. ($WEX). The stock has taunted us long enough! WEX did dip below our $75 Buy Below recently, and it’s started to run up again. I’m raising our Buy Below to $80 per share.

I’m also raising Bed Bath & Beyond ($BBBY) to $75 per share. The stock has responded well to its recent earnings report, and I don’t want it to run away from us. BBBY remains a very good buy.

That’s all for now. I told you this would be a short one. Don’t forget: earnings season kicks off next week. The stock and bond markets are still recuperating from the last Fed meeting. On Wednesday, we’ll finally get a look at the minutes from that meeting. I suspect that these minutes will confirm the view that the Fed is in no rush to shut off the money spigots. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

-

CWS Market Review – June 28, 2013

Eddy Elfenbein, June 28th, 2013 at 6:48 am“There is only one boss. The customer. And he can fire everybody in the company from the chairman on down, simply by spending his money somewhere else.”

– Sam WaltonAfter last week’s temper tantrum from the stock, bond and gold markets, officials at the Federal Reserve spent much of this past week trying to calm everyone down. The good news is that it’s worked. Or at least, it has thus far.

But the Fed is merely trying to save itself from yet another Fed-induced problem. They’re CYA-ing in a big way. While the FOMC’s policy statement was pretty much as expected, the after-meeting presser by Ben Bernanke was surprisingly hawkish. The markets responded quickly. At its recent low, the Dow was 991 points below its May high, and the yield on the 10-year Treasury got as high as 2.66%. That’s a full 1% increase in less than two months. Check out the down-and-up of the S&P 500 over the last few days:

So what’s going on?

In this week’s CWS Market Review, I’ll take a closer look at the market’s latest hissy fit. I also want to highlight the good earnings report from Bed, Bath & Beyond ($BBBY). It’s hard to believe BBBY was going for $57 just four months ago. It’s at $70 today. Our Buy List continues to hold up very well, and stocks like Wells Fargo ($WFC) have broken out to new highs. But first, let’s look at the latest song and dance from the Federal Reserve.

Bernanke’s Just a Guy Thinking about the Future and Stuff

At his June 18th press conference, Ben Bernanke said:

If the incoming data are broadly consistent with this forecast, the Committee currently anticipates that it would be appropriate to moderate the monthly pace of purchases later this year. And if the subsequent data remain broadly aligned with our current expectations for the economy, we would continue to reduce the pace of purchases in measured steps through the first half of next year, ending purchases around midyear.

The financial markets interpreted this to mean that QE would start to taper later this year (probably starting in September) and would end by this time next year. The back story is the belief that the Fed’s policies are the main reason why the bull market has been so strong. In my opinion, Bernanke and Friends have clearly helped, but it doesn’t follow that once the Fed pulls back—or takes its foot off the gas, in Bernanke’s analogy—the market will suddenly collapse.

Traders are capable of anything, but even I was surprised by their skittishness. Considering how many macho people there are in finance, the market as a whole can be one big fraidy cat. In four trading days (last Wednesday to Monday), the S&P 500 lost 5%. I think the folks inside the Fed were genuinely shocked by the market’s strong reaction.

This week, one Fed official after another stressed that no plans are set in stone, and the Fed will alter policy as needed. If you want to hang with the popular kids, the term for this is “data dependent.” In fact, this week’s GDP report was pretty weak, and it most likely will give ammo to folks who think QE needs to go on awhile longer.

Binyamin Appelbaum, the New York Times reporter, got it exactly right when he tweeted, “The Fed’s new message seems to be that Bernanke was just a guy who happened to be thinking out loud about the future and stuff.” Scary, but that’s how they’re acting. The minutes from this past meeting are due out on July 10th, and I think a lot of folks are very curious to hear what was said. But for now, the good news for investors is the Fed realizes how damaging their words can be.

What’s the Fallout?

The Fed did indeed calm the market down. The three-day rally on Tuesday, Wednesday and Thursday caused the S&P 500 to gain more than 2.5%. The Dow once again jumped to over 15,000. Perhaps the most dramatic impact was seeing the Volatility Index ($VIX) drop from nearly 22 on Monday to less than 17 by the end of the day on Thursday.

What investors need to understand is that the Fed is watching the economy, and they’re not about to shut off the spigots while the flow is still needed. The lower rates have greatly helped the interest-rate-sensitive areas of the market. I’ve spoken of this before as the magic equation: any place where consumer spending intersects with finance has been a winner. Examples of this include credit-card companies like Mastercard ($MA) and American Express ($AXP). The homebuilding stocks have also done very well. On our Buy List, the magic equation can be seen in stocks like Ford ($F) and JPMorgan Chase ($JPM).

Since the Fed has its hand in interest rates, it can obviously help those rate-sensitive areas. The question is whether the economy is strong enough that it can go along without the Fed’s help. The big clue for this will be second-quarter earnings season, which begins soon. Almost without anyone’s noticing, Q1 earnings growth was positive, and that didn’t happen in either Q3 or Q4 of last year. In other words, earnings growth is reaccelerating, meaning the rate of growth is itself increasing. We want to see that continue in Q2. Wall Street expects to see earnings growth ramp up pretty quickly in Q3 and Q4. If that does indeed happen, a lot of the Fed’s worries will go away.

I suspect that the S&P 500 will stay at or below its 50-day moving average for a while longer (the 50-DMA is currently at 1,620.42). Our Buy List has held out very well over the last two months, and it will continue to lead the market as investors seek out high-quality names. Please pay close attention to my Buy Below prices on our Buy List.

The key area to watch won’t be the stock market but rather the bond market and its close cousin, the gold market. In fact, gold has been getting crushed lately. On Thursday, the Midas metal dropped below $1,200 per ounce for the first time in nearly three years. The drop in gold is really a rise in short-term real interest rates, meaning the rates after inflation. I think gold is acting as an early warning signal, and within a few months, the interest-rate-sensitive areas will start to lag the market. We’re already seeing signs of this with the Homebuilding Sector ($XHB), thanks to higher mortgage rates. The commodity stocks have also been very poor performers. The Energy Sector ETF ($XLE) and the Materials Sector ETF ($XLB) have badly lagged the market.

A major trend for next year may be consumer staples stocks, but we’re far too early to see that kind of rotation. For now, investors should continue to focus on high-quality names. One stock on our Buy List that looks particularly attractive at the moment is Cognizant Technology Solutions ($CTSH). The shares got beat up in April, but now the dust has settled. CTSH is a very good buy up to $70 per share.

Bed Bath & Beyond Is a Buy up to $73 per Share

After the market closed on Wednesday, Bed Bath & Beyond ($BBBY) reported fiscal Q1 earnings of 93 cents per share. That hit Wall Street’s forecast square on the nose. On the conference call back in April, the home furnisher told us to expect Q1 earnings between 88 and 94 cents per share. I said in last week’s issue that I was expecting them to come in near the high end of that range, and that proved to be the case.

Let’s look at the numbers. BBBY earned 89 cents per share for last year’s Q1. For this year, quarterly sales rose 17.8%, to $2.612 billion. But the most important metric for retailers is comparable-store sales, and that rose a healthy 3.4% last quarter.

With a company like BBBY, I’m not too concerned about their missing or beating expectations by a few pennies per share. That’s no big deal. What’s important to me is that the general trend is upward.

If you remember, the shares got pummeled last year (a few times actually). But here’s the thing: yes, the company had some minor short-term issues, but this is a very well-run outfit, and they’ve worked to correct that. The stock dropped to $57 earlier this year, and in the February 15 issue, I said BBBY had become a very good buy.

For Q2, Bed Bath & Beyond sees earnings ranging between $1.11 and $1.16 per share. Wall Street had been expecting $1.15 per share, so this was in range. For the entire year, BBBY sees earnings between $4.84 and $5.01 per share (they made $4.56 per share last year). That number for the low end is way too low. Wall Street had been expecting $5.01 per share. I had said I was expecting $5 per share.

As you’ve probably heard me say many times before, I’m not a big fan of share buybacks. However, BBBY does it in a way that actually reduces share count, so I’ll give them credit for that. Their balance sheet is rock solid, with no debt and lots of cash. We have a nice 25% YTD profit in this stock. BBBY is an excellent buy up to $73 per share.

Moog Is a Buy up to $55 per Share

Before I go, I’m raising the Buy Below price on Moog ($MOG-A) to $55 per share. The stock has been holding strong lately, above $50 per share. The company had a good earnings report for Q1, and the CEO said business should improve for the second half of the year. Moog is a solid buy.

There’s also one small item about DirecTV ($DTV). The satellite-TV operator overstated the number of subscribers it has in Brazil. This appears to be an honest mistake. The stock dropped sharply at the open on Thursday, but rallied back as the day wore on. DTC continues to be a good buy up to $67 per share.

That’s all for now. Next week will be a rather unusual week in that the stock market will close early on Wednesday, July 3rd and will be closed all day on July 4th. There will only be three full trading days over a nine-day stretch. Despite the limited exchange hours, the ISM report will come out on Monday. The ADP report comes out on Wednesday, and finally the big jobs report is due out on Friday, July 5th. Traders will definitely be monitoring the progress of the labor market. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

-

CWS Market Review – March 15, 2013

Eddy Elfenbein, March 15th, 2013 at 7:18 amGrace Kelly: Where does a man get inspiration to write a song like that?

Jimmy Stewart: He gets it from the landlady once a month.

– Rear WindowTen days in a row! Through Thursday, the Dow has risen for an amazing ten straight trading days. This is the longest winning streak in more than 16 years. The big question on Wall Street is which will happen first—the Miami Heat will lose or the Dow will fall. This one might be close. It’s true that much of the Dow’s strength has been due to IBM. Thanks to price weighting, Big Blue now makes up more than 11% of the Dow.

For those keeping track, the Dow’s longest-ever winning streak came at the start of 1987 when the index rose for 13 days in a row. In this case, unlucky 13 may have been an omen for what came later that year.

The S&P 500 has been no slouch. That index, which is the one I prefer to follow, has been up for nine of those ten days; it dropped slightly this past Tuesday. The S&P 500 is now just inches away from cracking its all-time high close from October 9th, 2007. Daily volatility continues to be very mild. On Thursday, the VIX finished the day at 11.30 which is its lowest close in more than six years. Since the high point on New Year’s Day, the VIX has been cut in half.

It’s times like this that we need to remind ourselves not to get carried away. Sure, it’s fun watching your stocks go up each day but we have to temper our expectations. Markets don’t always do what they’re told. Remember that since this bull market started four years ago, the S&P 500 has fallen by 10% three separate times. We rode out all of those bumps and were rewarded each time. Our strategy continues to have three prongs—be patient, be disciplined and focus like a laser on high-quality stocks going for decent valuations.

In this issue of CWS Market Review, I want to take a closer look at the economy. The broader economic trends are stronger than many people realize. Although growth was pretty weak during the fourth quarter of 2012, the economy is poised to do fairly well this year, especially during the latter half of the year. Let’s look at some of the recent good news.

The Economic Recovery Is Gaining Strength

When I say that the economy is doing better, I don’t want to overstate my case. There are still 12 million Americans out of work, and Uncle Sam is piling up red ink. But there are concrete signs that the economy is fighting back.

Last Friday, the government reported that the U.S. economy created 236,000 new jobs in February which was 65,000 more than Wall Street had expected. There was actually a net decrease in the number of public-sector jobs by 10,000, so the private sector added 246,000 jobs. We still have a long way to go, but the numbers are moving in the right direction. The jobless rate for February fell to 7.7%, which is the lowest since 2008.

On Wednesday, we got more good news when the Commerce Department reported that retail sales jumped by 1.1% last month. That was more than double the rate economists were expecting. This is good news because it mollifies two concerns. One was the fear that higher payroll taxes would cause Americans to hold off on shopping. That doesn’t appear to be the case. The other concern was that retail sales would only go up due to higher gasoline prices. True, that had an impact, but even after subtracting for gas prices, retail sales still rose by a healthy 0.6%. Economists also like to look at core retail sales which ignore volatile sectors like gasoline, cars and building supplies. For February, core sales had risen by 0.4%. The positive retail-sales report is good news for Buy List stocks like Ross Stores ($ROST) and Bed Bath & Beyond ($BBBY).

On Thursday, the Labor Department reported that first-time jobless claims dropped by 10,000 to 332,000. That’s the lowest in two months. Economists were expecting 350,000. This number tends to jump around a lot, so many folks prefer to follow the four-week moving average, which is now at a five-year low.

We even had some bright news on Uncle Sam’s worrisome finances. The Treasury Department said that the monthly budget deficit for February dropped by 12% from a year ago. The CBO now estimates that the deficit for this year will be a mere $845 billion. Pocket change! But seriously, this would be lowest deficit, by far, in four years.

JPMorgan Chase and Wells Fargo Raise Their Dividends

Our Buy List continues to do well, and several of our stocks like Fiserv ($FISV), Oracle ($ORCL) and Stryker ($SYK) are at new 52-week highs. JPMorgan Chase ($JPM) also just touched a new 52-week high, but I need to confess some embarrassment here. In last week’s CWS Market Review, I predicted that House of Dimon would soon raise its dividend to 30 cents per share. The problem was that JPM’s dividend already was 30 cents per share. My goof! What makes this all the more embarrassing is that I correctly predicted that increase a year ago.

At least I was right about a dividend increase. After the closing bell on Thursday, JPMorgan announced that it plans to pay out 30 cents per share for the first quarter and increase that to 38 cents per share for the second quarter. That’s a planned increase of 26.7%. The Federal Reserve gave the bank approval to increase its dividend, but they need to resubmit their capital plans. Unfortunately, the bank is still in the political hot seat due to the London Whale fiasco. JPM remains a very good buy up to $52 per share.

Wells Fargo ($WFC) also raised its quarterly dividend. Their dividend will increase from 25 cents to 30 cents per share, which is a 20% raise. This is the second dividend increase from WFC this year. In January, the bank increased its dividend from 22 cents to 25 cents per share. WFC is a very solid bank. I’m raising the Buy Below on Wells Fargo to $40 per share.

Bed Bath & Beyond Is a Buy up to $62

In the CWS Market Review from four weeks ago, I said that Bed Bath & Beyond ($BBBY) had become a very attractive value. The home-furnishings retailer had been slammed a few times last year after it gave weaker-than-expected guidance. I think the market had overreacted, which is what markets often do.

I was pleasantly surprised to see that last weekend, Barron’s jumped on the BBBY bandwagon. The magazine said that BBBY “could” fetch as much as $85 per share. True, “could” is a rather broad word, but the key fact for us is that BBBY is a very well-run outfit. Barron’s wrote:

Bed Bath has had no direct competition since Linens ‘n Things was liquidated in 2008 after a bankruptcy. It controls an estimated 25% of the domestic home-furnishings market. Department stores offer limited competition because clothing generally generates higher profits per square foot of selling space than housewares.

Bed Bath’s strategy is unlike any other major retailer’s. It rarely advertises and usually avoids markdowns except on seasonal items, while providing excellent customer service. It targets customers with coupons offering a 20% discount, or $5 off, a single item (with a wide number of excluded products) to help drive traffic. As savvy shoppers know, Bed Bath & Beyond generally accepts expired coupons, and it’s known for a liberal returns policy—customers sometimes needn’t present a receipt. And they often present multiple coupons. The approach works because many customers come for a single item and leave with many, as they walk around the “racetrack” layout of the narrow-aisled stores.

Bed Bath & Beyond has zero debt and impressive operating margins. They’re sitting on nearly $4 per share in cash. While they don’t pay a dividend, BBBY is one of a few companies that truly buys back its own shares in an effort to reduce share count. Since 2004, share count has dropped by 100 million to 226 million. The next earnings report is due out in mid-April. I’m raising the Buy Below on BBBY to $62.

Moog Is a Buy up to $50

I’ve also been impressed with Moog ($MOG-A), which is one of our quieter stocks. On Thursday, Moog touched a new high and is now up 15.5% on the year for us. If you recall, the shares fell after the company lowered the high end of its full-year guidance. At the time, I told investors not to worry about Moog, and the stock has already made back everything it lost. The lesson is that good stocks often bend, but they rarely break. Moog is up more than 38% in the last four months. This continues to be a very good stock. I’m raising the Buy Below on Moog to $50.

Next week, we have three earnings reports coming up: Oracle ($ORCL), FactSet Research Systems ($FDS) and Ross Stores ($ROST). I previewed the earnings reports in last week’s issue. I think Oracle is the strongest candidate for a big earnings beat. The company told us to expect earnings to range between 64 and 68 cents per share. I think Oracle made at least 70 cents per share, but I suspect they’ll be conservative with their guidance.

That’s all for now. The Federal Reserve meets on Tuesday and Wednesday of next week, and it will include a Bernanke presser. I’ll be very curious to see any language changes from the Fed. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

-

Moog Lowers Guidance

Eddy Elfenbein, January 25th, 2013 at 9:57 amWe got our first disappointment of this earnings season. Moog ($MOG-A) said today that it’s lowering its full-year guidance. The previous range was $3.50 to $3.70 per share. The new range is $3.50 to $3.60 per share. That’s honestly not that bad and the CEO was quite candid:

“We’re off to a slow start in 2013,” said John Scannell, CEO. “The weakness in the major economies around the world is affecting our industrial business. On the other hand, the aircraft market is strong. We have moderated our forecast for the year slightly but we are still projecting growth in both sales and earnings in 2013, despite the headwinds in our industrial markets.”

Quarterly revenues were up 3% to $621 million. Net earnings dropped 6% to $34 million. On a per-share basis, Moog made 75 cents last quarter. Since no one follows them, I can’t say if that beat or missed expectations.

At one point early in today’s trading, Moog was as low as $40.06 which is a drop of 11.6%. The stock, however, quickly recovered and is now down 60 cents which is a loss of 1.3%. If you own Moog, there’s no need to worry about today’s news. The stock still looks good for the long-term.

-

Facebook Gets an Upgrade

Eddy Elfenbein, November 26th, 2012 at 10:38 amThe S&P 500 is down this morning but we’re still above the key 1,400 level. Here’s an interesting fact I noticed this morning: When the S&P 500 first got to where we are today, Barack Obama was 37 years old.

Speaking of President Obama, the White House issued a report this morning saying that if Congress doesn’t act on the “Fiscal Cliff” (a registered trademark of CNBC), all sorts of awful terrible things are going to happen. The financial media says that this is why the markets are down. I can’t say if that’s true (who knows why the market does what it does?) but I wouldn’t think a report like that would scare traders for long.

According to the AP, Americans spent $59 billion over the Black Friday weekend. That’s up 13% from last year and an all-time record. I should add Barry Ritholtz’s advice to be very wary of any claims of robust Black Friday sales.

Facebook ($FB) is up this morning to $25.72 as an analyst at Bernstein raised his price target to $33. Sorry, but I still think that’s way too high.

Ethan Allen ($ETH) has had a very strong year. The company just announced a 41-cent special dividend. I love seeing that. Most companies would be tempted to waste it on a poor acquisition. Why not give it back to the owners? Good for ETH.

I sent out the latest CWS Market Review last night (a bit delayed due to Thanksgiving). In it, I mentioned the upcoming earnings report from Jos. A Bank ($JOSB) but noted that the company hadn’t yet set an earnings date. This morning, the company said it will hold its conference call on Thursday morning so I assume the earnings will come out earlier that morning. Wall Street expects earnings of 55 cents per share which would be a one penny increase over last year.

Seth Jayson at the Motley Fool has a nice write-up on Moog ($MOG-A).

-

CWS Market Review – November 16, 2012

Eddy Elfenbein, November 16th, 2012 at 7:17 am“Investing is where you find a few great companies and then sit on your ass.” – Charlie Munger

So true, Charlie. So true. Unfortunately, sitting on our rear ends has been rather unpleasant lately as the stock market has thrown yet another temper tantrum. On Thursday, the S&P 500 broke below 1,350 for the first time since late July.

For several weeks now, I’ve warned investors to be prepared for a difficult market this autumn. The hour cometh, and now is. The day after the election, the S&P 500 dropped 2.37% for its second-worst day of the year. This was unusual because the electoral results were largely expected. The next day, the index closed below its 200-day moving average for the first time since June. That apparently gave the bears a shot of confidence. Yesterday, the index fell to its lowest level since July 26th.

In this week’s CWS Market Review, we’ll take a closer look at what has the market so grumpy. The good news is that it shouldn’t last much longer; I expect a strong year-end rally to begin soon. I’ll also highlight Medtronic’s ($MDT) upcoming earnings report. I’m a big fan of this medical devices company which has increased its dividend for 35 years in a row! Plus, I’ll show you some Buy List stocks that look especially good right now. But first, let’s look at why the market’s recent downturn is running out of steam.

Why This Sell-Off Will End Soon

Measuring from the market’s closing peak on September 14th, the S&P 500 is now down 7.64%. That’s hardly a horrifying drop especially considering the market’s tremendous run over the last three-and-a-half years, but it caught a lot of professionals off guard. Actually, it’s not even the worst drop this year. We’re still short of the 9.93% sell-off the S&P 500 put on between April 2nd and June 1st.

If we dig beneath the numbers of this current sell-off, we can see it has been unusual which leads to me believe that it’s a reaction against events rather than a sober judgment of future corporate cash flow. As sophisticated as we may think Wall Street is, the truth is that traders often act like hyperactive children at a swimming pool (“hey, look at me, look at me, are you looking??”). Simply put, this market is an attention whore.

I’ll give you an example. When the market initially broke down, the Financial sector led the way. That’s to be expected. But what’s interesting is that it didn’t last long. After two weeks, the financials turned around and started leading the market (meaning, not falling as much). That’s unusual. Investors don’t normally turn to financial stocks for comfort during stressful periods.

Broadly speaking, the cyclicals have had similar reactions. For example, the Industrials have been particularly strong and until very recently, the homebuilders were acting like all-stars. We can also see a lot of strength in the Transportation sector. Again, that’s not the usual pattern that a recession is on the way. The economic data continues to suggest that housing is helping consumer spending get back on its feet.

Nor has the bond market reacted as strongly as you would expect. The yield on the 10-year Treasury is back below 1.6%, but it is well above the ultra-low yields we saw this summer. Furthermore, the volatility of Treasury bonds has nearly dried up. Despite the problems in Europe, our economy continues to recover, albeit at a tepid pace. Expect to see Treasury yields gradually creep higher as investors migrate towards bargain stocks.

A worrying market would be when investors bail out of Financials and Cyclicals and crowd into bonds and Defensive stocks. That’s pretty much what we saw during the spring. This time around, the laggards have largely concentrated on the Tech space. This is where things get truly weird. Intel ($INTC) dropped for nine days in a row and now yields 4.5%. Microsoft ($MSFT) is at its low for the year. And look at Apple ($AAPL). Heavens to Murgatroyd! That stock is down more than $180 in less than two months. That’s a loss of $170 billion in market value, or $540 per every American.

But our Buy List continues to motor along. Since October 15th, the S&P 500 is off by 6.03% while our Buy List is down by 4.40%. Obviously, our goal is to profit, not lose by less, but it’s a good sign that our conservative approach holds up well when Wall Street decides to be a drama queen. We have an excellent shot of beating the market for the sixth year in a row.

Another reason for optimism is that downward momentum is starting to exhaust itself. An important gauge that a lot of chart watchers like to follow is the 14-day relative-strength index. The 14-day RSI closed below 30 for the first time since June. This may cause some bulls to jump back into the fray. Plus, the earnings outlook is holding its own. While earnings estimates for Q4 have come down, the consensus on Wall Street still expects growth of 9.4% which is a nice change from the earnings decline of 3.5% for Q3.

Investors are clearly concerned about a number of political factors. For one, there’s the prospect another stand off between the White House and Congress over the impending “fiscal cliff.” Personally, I doubt this will be as serious as some people fear. The business community is clearly not in the mood for more political drama. I have to think that some sort of deal will be reached before any economy-wrecking plans take effect. There’s too much to lose.

Investors need to be disciplined and not expect the market to gain 20% overnight. Our Buy List is poised to do well, and we just had another good earnings season. Continue to focus on strong dividends, especially companies with long histories of raising their payouts. Speaking of which, we have an earnings report coming next week from one of my favorite dividend champions.

Medtronic Is a Buy Below $44

Medtronic ($MDT) is due to report its earnings on Tuesday, November 20th. If you’re not familiar with them, Medtronic makes medical devices such as products that treat diabetes. The company has increased its dividend every year for the last 35 years.

This earnings report will be for their fiscal second quarter which ended in October. Wall Street currently expects earnings of 88 cents per share which would be a small increase over the 84 cents per share from last year’s second quarter. Medtronic’s earnings reports are usually very close to expectations. If not dead on, it’s rarely more than one or two pennies per share off. In fact, that’s one of the reasons why I like MDT.

Medtronic used to be a glamour stock but it’s lost a lot of its luster. The P/E Ratio has been massively squeezed but the company still churns out steady earnings growth. I was pleased to see Medtronic’s stock turn a corner earlier this year. As traders got nervous and bailed out of riskier bets, Medtronic’s stability suddenly become attractive. From June 4th to October 4th, MDT jumped 24%, although it has given back 8.5% since then.

Medtronic sees earnings ranging between $3.62 and $3.70 per share for this fiscal year. That works out to growth of 5% to 7%, and it means the stock is going for 11 times FY 2013 earnings. The company seems to be on track towards hitting their target. This is a very good stock but I don’t want you to chase it. I’m lowering my Buy Below price to $44 per share.

Some Buy List Bargains

The market’s recent downturn has given us several attractive stocks on the Buy List. If you’re looking for income, Reynolds American ($RAI) currently yields 5.9%. Nicholas Financial ($NICK) is now below $12 per share which gives the stock a yield above 4%. As I predicted two weeks ago, Sysco ($SYY) raised their dividend by a penny per share. That makes 43 dividend increases in a row. SYY now yields 3.7%.

Moog ($MOG-A) currently looks very cheap. The stock just dipped to a new 52-week low. That’s odd because Moog just had a good earnings report and they reiterated their earnings guidance of $3.50 to $3.70 per share. I think Moog can be a $45 stock within a year. Just to be safe, I’m going to lower my Buy Below price to $38 due to the recent sell-off.

Oracle ($ORCL) just dropped below $30 per share. This is a very good company. Oracle is now going for about 10 times next year’s earnings. Oracle is a strong buy up to $35 per share.

I also want to tighten up a few Buy Below prices due to the market’s recent sell-off. I’m lowering Bed, Bath & Beyond’s ($BBBY) Buy Below to $62. (How’s that for alliteration?) I’m also paring back CA Technologies ($CA) to a strong buy below $24. We have a lot of excellent stocks on our Buy List so per dear old Charlie, sitting on our asses is a wise strategy.

That’s all for now. Next week should be fairly quiet. The market will be closed on Thursday for Thanksgiving. On Friday, there will be an abbreviated session that ends at 1 p.m. This is usually one of the lightest volume days of the year. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

-

DirecTV Misses By Four Cents Per Share

Eddy Elfenbein, November 6th, 2012 at 10:38 amElection Day is finally here. I’m not in the business of trying to predict who will win, but I think the market will be very pleased to have the uncertainty behind us. The S&P 500 is back over 1,420 this morning but I don’t expect much price action this week.

The weak spot on the Buy List today is DirecTV ($DTV). The satellite TV company missed earnings by four cents per share. For their Q3, DirecTV earned 90 cents per share compared with Wall Street’s consensus of 94 cents per share. The good news is that revenue rose 8.4% to $7.42 billion which was $110 million better than consensus.

DirecTV added 543,000 net subscribers in Latin America, fewer than the 585,000 estimate from nine analysts surveyed by Bloomberg. The disappointing results may indicate a deterioration in the region’s economies, especially Venezuela, said Chris Marangi, a portfolio manager at Gamco Investors Inc. whose funds own 7.4 million DirecTV shares.

Latin American customer additions fell from 645,000 in the quarter ended in June. Last year, DirecTV reported 574,000 new Latin American users in the third quarter, an increase from the prior three-month period.

DirecTV added 67,000 net U.S. customers, less than the 99,000 average analyst estimate. The company has tried to entice subscribers with National Football League Sunday Ticket promotions, which give new customers access to all Sunday football games for free for a year. DirecTV also lowered the price for Sunday Ticket for current customers.

I also forgot to mention the good earnings report last Friday from Moog ($MOG-A). The company reported earnings 91 cents per share which was two cents better than estimates. Moog earned 83 cents per share for the same quarter one year ago.

This was for their fiscal fourth quarter. For the entire year, Moog earned $3.33 per share which was a nice increase over the $2.95 per share they earned in the year before that. Moog reiterated its earnings forecast of $3.50 to $3.70 per share for the coming year. That’s a very good number.

“Over the last three years, sales have increased 34% and earnings per share are up 68%,” said John Scannell, CEO. “We have delivered this improvement despite the reduced military spending and the tepid industrial recovery. We believe our diversity across markets and geographies, as well as our excellent position on the most important military and commercial programs has been the key to this strong performance and we’re confident these factors will continue to benefit us in 2013.”

I think Moog is one of the cheaper stocks on our Buy List.

-

Moog Earns 85 Cents Per Share

Eddy Elfenbein, July 30th, 2012 at 1:09 pmI neglected to mention Moog’s ($MOG-A) earnings report from Friday. Moog isn’t a well-known company but it ought to be; they make flight control systems for commercial and military aircraft. Even though defense budgets have come under the knife in the U.S. and Europe, Moog is still doing well.

The company earned 85 cents per share for its fiscal third quarter which was a penny ahead of estimates. Moog had earned 73 cents per share in the same quarter one year ago. On the bad side, the company cut its 2012 revenue estimate just slightly from $2.47 billion to $2.45 billion. For 2013, they see full-year earnings ranging between $3.50 and $3.70.

If they hit $3.70 per share, that would be a very strong number. That means the stock is going for just under 10 times forward earnings. The stock is up about 2.5% today.

-

Archives

- March 2026

- February 2026

- January 2026

- December 2025

- November 2025

- October 2025

- September 2025

- August 2025

- July 2025

- June 2025

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His